Business/Personal Tax Transmitting: Pending status, Polling Again and Gateway busy, Establish connection

Article ID

business-personal-tax-transmitting-pending-status-polling-and-gateway-busy

Article Name

Business/Personal Tax Transmitting: Pending status, Polling Again and Gateway busy, Establish connection

Created Date

23rd December 2021

Product

IRIS Personal Tax, IRIS Business Tax, IRIS P11D, IRIS Trust Tax

Problem

IRIS Business/Personal Tax: Pending or No status, Polling Again and Gateway still processing OR busy and Problem Establishing connection to Gateway

Resolution

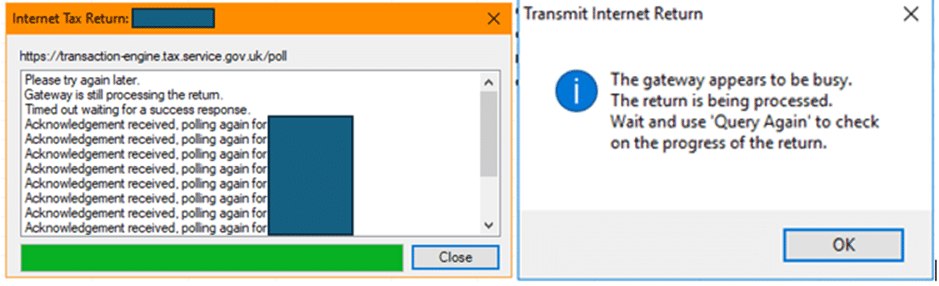

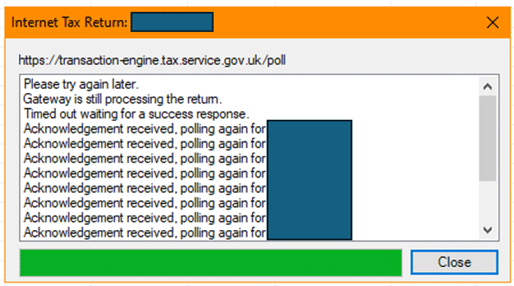

When you transmit a online return but get a ‘Polling again, please try again later’ OR ‘Gateway is busy’.

Any Gateway or Transmission issues are usually as a result of the HMRC server experiencing a busy period; self-assessment submissions or end of month submissions. In some cases it can be as a result of HMRC having technical issues.

Please read this KB if all clients are affected when trying to submit: https://www.iris.co.uk/support/knowledgebase/kb/personal-business-tax-problem-establishing-a-connection-to-gateway-the-gateway-may-not-be-available/

- Check your Internet connection is working and stable – any outages can cause this issue.

- Check your IRIS version is up to date – Help and About – older versions can cause issues when transmitting

- No Status – when you transmit a return a blank/empty Status and no transmission date is returned. This could be due to a time delay from the HMRC server. You can wait and see if the status changes or go to the next step and force the issue.

- Pending Status– when you transmit a return you get a Pending status. This is a reply from the HMRC server that they are trying to process the tax return.

If the status doesn’t update or stuck on Pending, try the following:

1.Go to the Transmit Internet return screen.

2. Click on the relevant row with ‘Pending‘ status. (If its another different status then still follow these steps)

3. Right click the row. Select ‘Reset status‘ and say yes to the option.

4. The Status column will now be empty, so highlight and click ‘Transmit’ again.

5. If you get the same issue then redo steps 2 to 4 but this time, delete the row and close the transmit screen. Now regenerate the Tax return and transmit again.

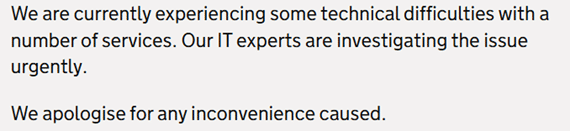

6. If you get the same issue then its very likely it’s a HMRC issue. Either try later or contact HMRC support. HMRC also have this website to report any issues (it may show like a paragraph like this, image below).

7. If you receive a receipt and a HMRC email confirmation, then double-check with HMRC. We have had cases where tax returns have been lost by HMRC. Having the email is proof that the return was sent to the HMRC.

8. If there is still a Pending status in the Transmit screen and HMRC have confirmed they have received the return (You have receipts) then you have 2 options: 1) Delete the pending row and regenerate as ‘Amended’ and submit again, if its fails then regenerate as ‘New’ and submit. Or 2) Keep an internal note that that return was received by HMRC.

If the Status option is still empty and you have all the HMRC receipts and email, then either wait and check again later to see a status in there OR generate an Amended return with the same values and submit that. There could be delays from the HMRC side where the status is not being updated in IRIS and causing this empty status. Do note you may get a 3304 error.

If you get ‘Polling and Gateway busy’ – HMRC are asking you to try later as the gateway is busy. After you close these messages you may get the ‘pending’ status.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.