Personal Tax- Where is overlap profit/relief entered for a sole trader?

Article ID

ias-12043

Article Name

Personal Tax- Where is overlap profit/relief entered for a sole trader?

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- The client commenced in business several years ago, we have been given a figure of overlap relief, where can this be entered?

Resolution

Overlap Profit/relief will be utilized if the trade has ceased OR a change in accounting period less than 18 months. If the change in accounting period is over 18 months, then the overlap relief will be carried forward and utilized next year.

Users are required to enter overlap relief as follows if the trade has ceased (or change in period) – if not ceased/or change of period then you cannot claim the relief:

1. Log into IRIS Personal Tax and select the client.

2. Click Trade Profession or Vocation then click Sole Trade or Partnership.

3. The right side of the screen is split into two with a list of account dates displayed in the bottom half of the screen, double click on the account date for the current year.

4. Click on the Adjustments, Losses, Overlap and Tax tab.

5. Enter the number of days and the amount of overlap profit into the section labelled overlap profit b/fwd then click OK to save. Overlap will be deducted automatically if there has been a relevant change of account date or there is a cessation. Then run the Trade Comp next.

6. If the relief is missing from the calculations – check and make sure last period is the ceased date, e.g. edit the period so its the ceased date. Then run the Trade Comp next.

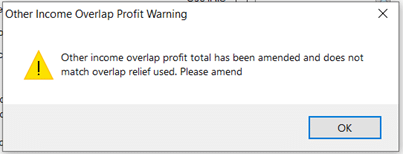

Other income overlap warning: If you get this warning when trying to save the day and £ values then PT has detected the entry is incorrect and you need to review the claim and also check where the entry was originally made (you would to check past years) to ensure its correct.

NOTE: Overlap relief will be utilized if there is a change in accounting period less than 18 months. If the change in accounting period is over 18 months, then the overlap relief will be utilized next year.

NOTE: Clients with a 31st March year end and it is carrying forward 5 days of overlap relief, why? PT is correctly calculating the 5 day overlap relief to be carried forward. You will not be able to utilize the full amount unless you change the year end from the 31st of March to the 5th of April. .

For information on how to enter overlap relief for a Partnership client please see KB Partnership Overlap relief will be deducted automatically if there has been a relevant change of account date there is a cessation or the partner leaves the business.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.