Personal Tax- Where is overlap profit/relief entered for a partnership?

Article ID

ias-12044

Article Name

Personal Tax- Where is overlap profit/relief entered for a partnership?

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- The client became a partner in a business several years ago; we have been given a figure of overlap relief, where can this be entered?

Resolution

Overlap Profit/relief will be utilized if the trade has ceased OR a change in accounting period less than 18 months. If the change in accounting period is over 18 months, then the overlap relief will be carried forward and utilized next year.

Users are required to enter overlap relief as follows if the trade has ceased (or change in period) – if not ceased/or change of period then you cannot claim the relief:

1. Log into IRIS Personal Tax and select the client.

2. Click Trade Profession or Vocation then click Sole Trade or Partnership.

3. The right side of the screen is split into two with a list of account dates displayed in the bottom half of the screen, double click on the account date for the current year.

4. Enter the number of days and the amount of overlap profit within the section title enter amounts for basis period then click OK to save.

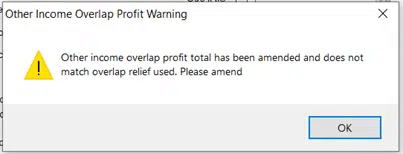

Other income overlap warning: If you get this warning when trying to save the day/£ values then PT has detected the entry is incorrect and you need to review the claim and also check where the entry was originally made (you would to check past years) to ensure its correct.

5. If the relief is missing from the calculations – check and make sure last period is the ceased date, e.g. edit the period so its the ceased date or the period change was less then 18 months. Then run the Trade Comp next.

For information on how to enter overlap relief for a self employed client please see KB Sole trade Overlap relief will be deducted automatically if there has been a relevant change of account date there is a cessation or the partner leaves the business.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.