Personal Tax- Complete Repayment claim on all Tax Returns

Article ID

ias-12114

Article Name

Personal Tax- Complete Repayment claim on all Tax Returns

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

Personal Tax- How can the repayment claim be completed automatically on all clients Tax Returns

Resolution

There are two methods to claim repayment 1) This KB you on on now, 2) The other KB here

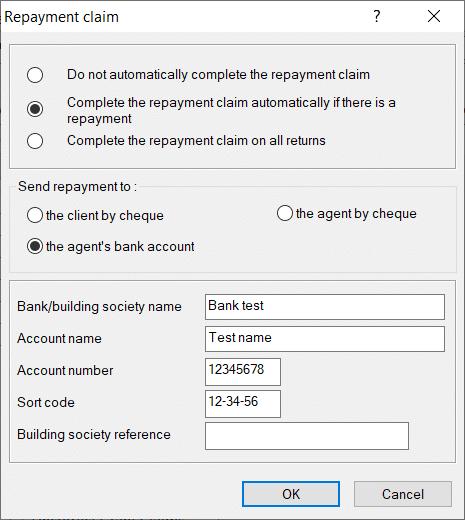

Use this to automate the completion of the repayment claim on the SA100 tax return. If data is entered manually in the Reliefs/ miscellaneous/Repayment data entry section for repayment claims it will override any automatic option entered here.

Note: Do not enter the clients bank details here – this section requires the agents bank details. If you only want to fill in the repayment details with the clients bank details (and not Agents) go to: Reliefs, Misc, Repayment Claims and complete all the sections. here

1. Log on to IRIS Personal Tax as a MASTER user and select a client

2. From the Setup menu select Repayment claim

3. Enable the required options with the sections of this screen then click OK

4. If you tick ‘The client/agent by cheque’ – it will grey out the agents bank detail fields

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.