Personal Tax- Edit/delete client Repayment claim on TR5?

Article ID

ias-12030

Article Name

Personal Tax- Edit/delete client Repayment claim on TR5?

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

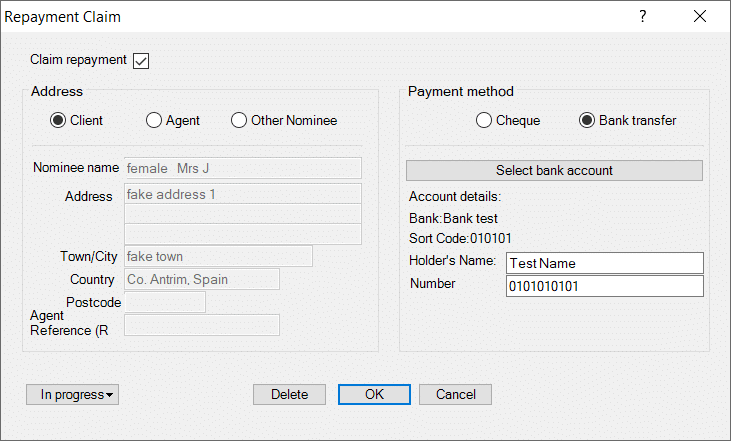

Personal Tax- To enter repayment details or if the option to claim a repayment has been un-ticked but IRIS is still putting details into question 19 of the Self Assessment Tax Return.

Resolution

There are two methods to claim repayment 1) This KB you are on now, 2) The other KB here

Use this to complete the repayment claim on the SA100 tax return for the selected client only. Note: If data is entered manually here then it will override any automatic option entered under Setup/Repayment Claims.

1. Log into Personal Tax and select the relevant client.

2. Click on the Relief’s tab, then click on the yellow folder labelled Miscellaneous then click on the Repayment Claim option.

3. Complete/Edit the sections/fields. If you need to enter Bank etc details- click ‘Select Bank account’.

4. If you need to delete then click the Delete button and click Yes to the prompt stating “Delete Repayment Details”.

5. If question 19 is still being completed after following the above steps please check the global settings via the Toolbar – Setup | Repayment Claim OR if you need to complete the repayment for all clients. See the KB link here

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.