AE Config Tool – Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Article ID

12051

Article Name

AE Config Tool – Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Created Date

1st May 2019

Problem

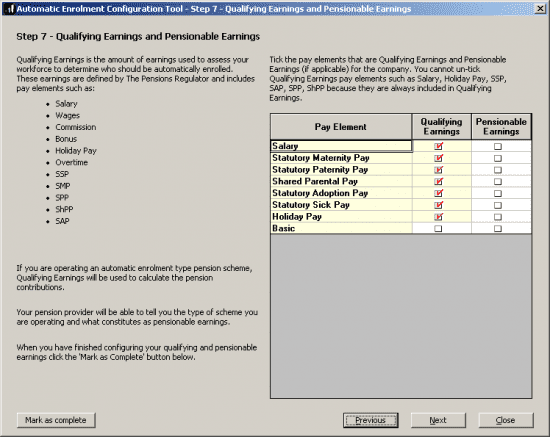

From this screen you can select pay elements that are included in Qualifying Earnings and Pensionable Earnings. A list of pay elements that are always included in Qualifying Earnings is shown here. If required, Pensionable Earnings are defined by your pension provider who can advise you what is classed as Pensionable Earnings for their scheme.

Before setting up any automatic enrolment details we strongly recommend you make sure your payroll software is up to date with the latest version.

Please visit our downloads page to check for updates to your software

Click here

Resolution

The list will show all the pay elements (payment/deductions and pay rates) currently configured for this company.

Simply tick the pay elements to indicate if you wish for them to be included as Qualifying or Pensionable earnings for the purpose of worker status assessment and contribution calculations.

Salary, Holiday Pay and the Statutory payments cannot be unselected as qualifying earnings due to legislation. If you are unsure what elements should be ticked you should refer to your pension provider for assistance.

If, in step 6, you chose the calculation basis as “Qualifying (Banded) Earnings” the software will use the sum of all the pay elements ticked as “Qualifying Earnings” to calculate the pension contribution.

If you set the calculation basis to “Pensionable Earnings” the software will use the sum of all the elements ticked as “Pensionable Earnings” to calculate the pension contribution.

Remember, when using the option “Qualifying (Banded) Earnings” the software will also trim off earnings below the auto enrolment lower threshold and above the auto enrolment upper threshold before calculating the contribution value.

When you are happy you have the correct pay elements ticked as Qualifying/Pensionable earnings click “Mark as complete“.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 1 – Your company’s staging date

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 4 – Pre-staging workforce assessment

Step 5 – Choose your pension provider

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 8 – Pension Provider output file details

Step 9 – Configure your Postponement Period

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.