AE Config Tool – Step 8 – Pension Provider output file details

Article ID

12052

Article Name

AE Config Tool – Step 8 – Pension Provider output file details

Created Date

17th October 2017

Problem

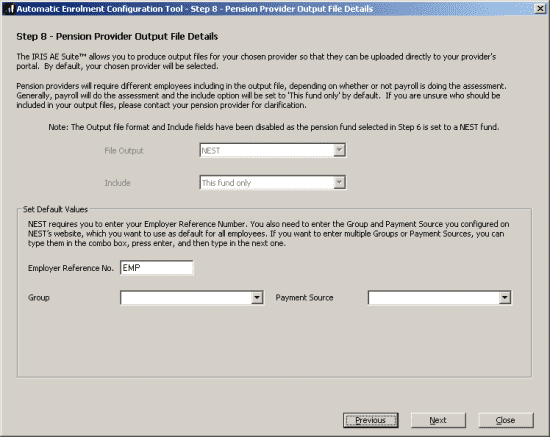

This screen allows you to choose which format to use when creating the output file for your pension provider. The Include option is generally set to All Employees in the pension scheme. This can be changed should your pension provider require different employees to be submitted in the output file.

Resolution

The options on this step will change depending which pension provider was selected in step 5. We have attempted to use the same terminology as the individual pension providers for clarity.

The details requested here are normally configured by the user when creating the fund with the provider. To ensure your pension export files are accepted by the provider make sure all details match exactly with what has been configured at their end. These fields ARE case sensitive and must match exactly what the pension provider has.

• NEST require an “Employer Reference Number” (starting EMP) at least one “Group” and at least one “Payment Source“.

• Aviva requires a “Category ID“

• Friends Life require an “Employee Category“

• NOW require an “ER Code“, a “Scheme Code” and a “Pay Code“

• People’s Pension require a “Unique ID” and an “AE Worker Group“

• Royal London requires a “Category Identifier“

• Scottish Widows require a “Pension Worker Group” and a “Pay Group“

• Standard Life requires a “Site Code“

Include: This option sets which employees are included in the export files when produced. If you are unsure which option to use contact your pension provider.

• “This Fund only”: Only employees contributing to the selected fund would be included in the export.

• “This Fund and no fund”: Employees contributing to the selected fund will be included. Any employees the software recognises as not being assigned to ANY fund (ie. no pensions) will also be included.

• “All employees”: All employee included in the pension export regardless of pension fund status.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 1 – Your company’s staging date

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 4 – Pre-staging workforce assessment

Step 5 – Choose your pension provider

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Step 9 – Configure your Postponement Period

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.