AE Config Tool – Step 9 – Configure your Postponement Period

Article ID

12053

Article Name

AE Config Tool – Step 9 – Configure your Postponement Period

Created Date

15th January 2020

Problem

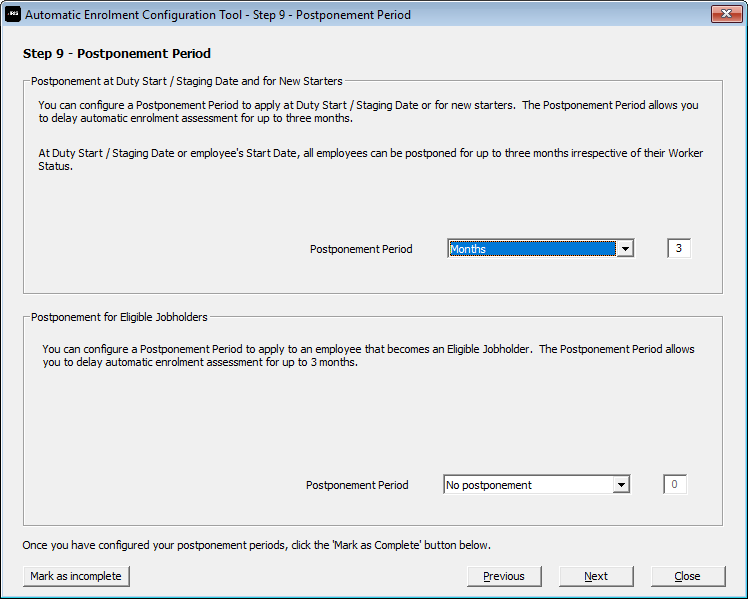

This screen allows you to set up postponement periods for:

• Staging Date/New Starters

At Staging Date/employee’s Start Date, all employees can be postponed for up to three months irrespective of their Worker Status

• Eligible Jobholders

A Postponement Period can apply to an employee on the date they become an eligible jobholder

Resolution

There are two options for applying a postponement period, from staging/duty start date and from the point an employee becomes an eligible jobholder.

Postponement at Duty Start / Staging date and for New Starters: When your workforce is first assessed after your staging date you are entitled to postpone them for up to 3 months regardless of the worker status. Simply select the period of postponement you wish to apply. After this, whenever you add a new employee, this postponement period will also be applied when they are first assessed in your software.

Postponement for Eligible Jobholders: This option controls how long an employee would be postponed after the software assesses them as eligible and updates their worker status. Again you can set this up to 3 months. Example, an employee has been paid and assessed as a non-eligible jobholder. In the next month their pay goes up, this time, the software assesses them as an eligible jobholder. At this point, the software will look to auto enrol the employee into the pension scheme. If you have configured a postponement period here they will not be enrolled but postponed for the length of time you have selected. At the end of this postponement period, the employee is assessed again. If their earning have dropped below the eligible jobholder threshold they wouldn’t be enrolled. If their earnings are still high enough to be an eligible jobholder the software will enrol them into the scheme.

Please Note: An employee under postponement can choose to forgo this and start contributions early.

Once you are happy with the setting click “Mark as complete“.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 1 – Your company’s staging date

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 4 – Pre-staging workforce assessment

Step 5 – Choose your pension provider

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Step 8 – Pension Provider output file details

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.