How to enter a negligible value claim?

Article ID

108257

Article Name

How to enter a negligible value claim?

Created Date

26th September 2019

Product

Problem

How to enter a negligible value claim?

Resolution

This topic explains the process for entering a negligible value claim.

- Log on to IRIS Personal Tax and select the client.

- From the Edit menu select Capital Assets.

- Enter the loss into the system via one of the three options available.

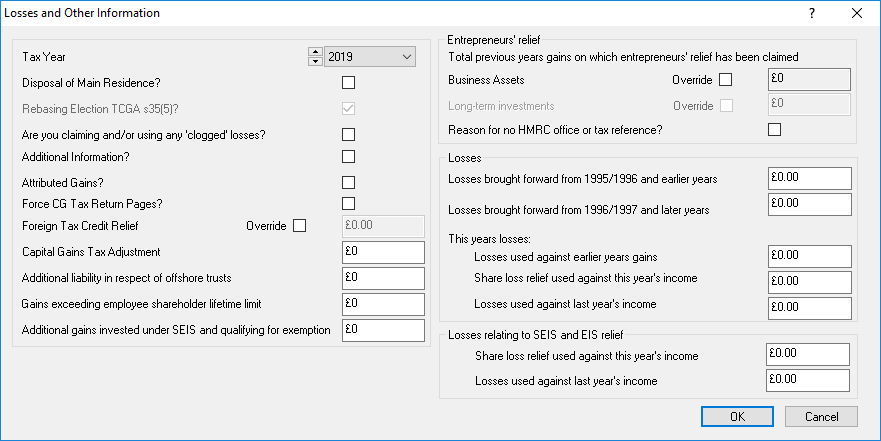

- To offset this loss against the clients other income which arose in the year; select Edit(next to file) from the Capital Assets menu bar, then select Loses and Other Information.

- Complete the Losses used against this year’s income box within this screen.

This loss will now show as a deduction on the clients tax computation.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.