An employees CSA deduction is coming off higher than the standard deduction.

Article ID

11284

Article Name

An employees CSA deduction is coming off higher than the standard deduction.

Created Date

6th April 2017

Product

IRIS PAYE-Master

Problem

An employees CSA deduction is coming off higher than the standard deduction.

Resolution

CSA deductions are subject to “Protected Earnings” whereby an employees pay cannot be brought below a certain level by this deduction.

If the employees pay isn’t high enough to take the full amount without going below the protected earnings the system will take as much as it can up to this level.

Any remaining balance that couldn’t be processed is saved in the system as “Deductions Brought Forward”

If, in a future pay period, the employee is paid enough to cover the whole standard deduction the system will look to catch up any brought forward amounts up to the protected earnings level.

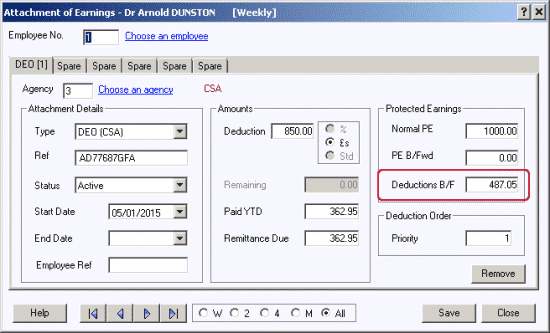

The system will save any values for deduction brought forward in the attachment set up screen for the employee:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.