Postponement / Deferral Dates - Automatic Enrolment FAQs

Article ID

11625

Article Name

Postponement / Deferral Dates - Automatic Enrolment FAQs

Created Date

6th September 2018

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

How does the system assign postponement / deferral dates to employees?

Resolution

Automatic enrolment, postponement and deferral dates are assigned by the system based on information in the “Payroll Calendar”, the “Configure Auto Enrolment” window and the pay period the assessment occurs ie. when payroll is processed.

Before recording any auto enrolment details please make sure you are running the latest version of the software.

Click here to check for updates.

PAYROLL CALENDAR

Go to “Company” > “Payroll Calendar” to check this detail. The dates typed in here should reflect the period of work the employees are being paid FOR.

Please Note: There is no payroll calendar option in IRIS PAYE-Master or IRIS GP Payroll. Instead, both of these products use the HMRC tax calendar instead ie. 6th April – 5th May = Month 1

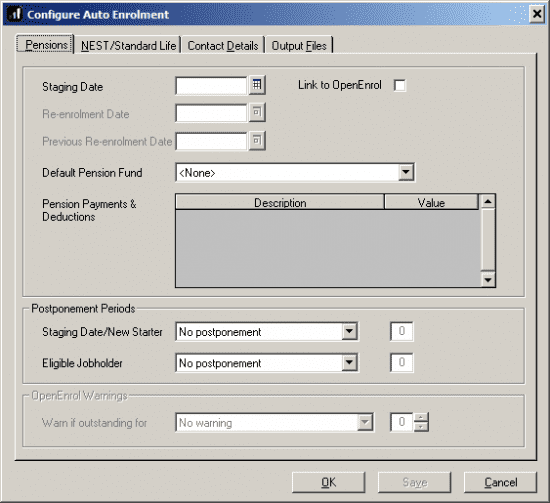

CONFIGURE AUTO ENROLMENT

Go to “Pension” > “Configure Auto Enrolment“

Postponement Periods

You have two options here, the postponement that will be applied to all employees at the staging date and then any subsequent new starters. There is then a separate option to configure the postponement that would be applied when an existing employee’s worker status changes to Eligible job holder.

When does the postponement period configured in the software apply?

Once configured, the postponement will apply when any of the following criteria are met:

- At your Staging Date – for all workers

- On the first day of employment after Staging Date, i.e. the worker’s Start Date

- On the date a worker meets the criteria to be an eligible jobholder after the Staging Date

- Postponement at staging date and for new starters is also applicable to workers under 22 and SPA or over

PLEASE NOTE: The postponement period set at the company level is applied from the pay period you are processing not the staging date. For employees to be postponed correctly it is important you have all the AE details in the system BEFORE your staging date, even if you intend to postpone all employees from that date.

Example: Your staging date is 1st April. As you don’t intend to enrol anyone in this period you run month 1 payroll without AE details in place. Before you run month 2 you set all the AE details in place and select 3 months postponement. When you run month 2 any eligible jobholder will be postponed for 3 months from month 2 ie until August rather than July as you require.

This is because the postponement period doesn’t just apply from the 1st period of AE but EVERY time an employee becomes an eligible jobholder.

How does the payroll system decide what dates to use?

The payroll software uses the Payroll Calendar to determine an employee’s Pay Reference Period (PRP). The PRP determines the automatic enrolment, deferral and postponement dates. This works by:

- Identifying the Payroll Date for the period being paid

- Determining which Start and End dates in the Work Period contain the Payroll Date (From the payroll calendar, see above).

- These Start and End dates are the start and end dates of the Pay Reference Period

What is the pay reference period?

This is the period of time an employee’s auto enrolment assessment is based on; the period by reference to which the employee is paid their regular wage or salary.

To determine an employee’s Pay Reference Period (PRP), the payroll:

• Identifies the Payroll Date for the pay period being paid

• Checks the Payroll Calendar to determine which Start and End dates contain the Payroll Date

These start and end dates may be in a different pay period to the actual period for which the employee is being paid; this often occurs if the employee is paid a week in arrears.

For more information on Pay Reference Periods see https://www.thepensionsregulator.gov.uk/docs/dg-4-appendix-e.pdf

Quick Examples when employees will be assessed (no postponement, monthly payroll):

From Staging:

Staging Date is 1st October

Payroll for Month 6

Pay Reference period is 6th September – 5th October.

Pay Date is 30th September.

Payroll for Month 7

Pay Reference period is 6th October – 5th November.

Pay Date is 30th October.

The assessment will take place in Month 6, as the staging date falls within the PRP and will set the Auto Enrolment date as 1st October (as it is the earliest possible date).

From turning 22:

Payroll for Month 7

Pay Reference period is 6th October – 5th November.

Pay Date is 30th October.

Employee’s 22nd Birthday – 1st November

The assessment will take place in Month 7 as the D.O.B falls within the PRP and will set the Auto Enrolment date as 1st November.

New Starter:

Payroll for Month 7

Pay Reference period is 6th October – 5th November.

Pay Date is 30th October.

Employee’s start date is 15th October.

The assessment will take place in Month 7 as the start date falls within the PRP and will set the Auto Enrolment date as 15th October.

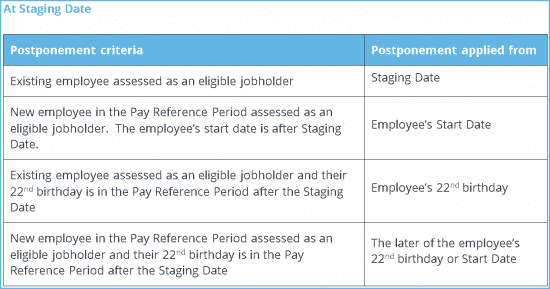

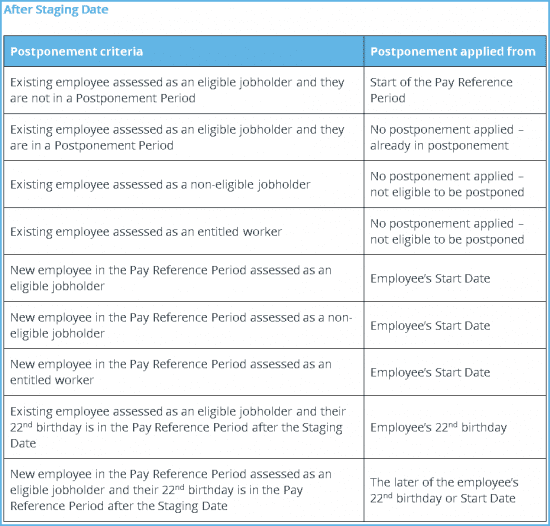

Postponement Scenarios:

The Postponement Period will start from different dates depending on when the employee met the criteria to be postponed and whether your company’s Staging Date has passed or not.

Further examples

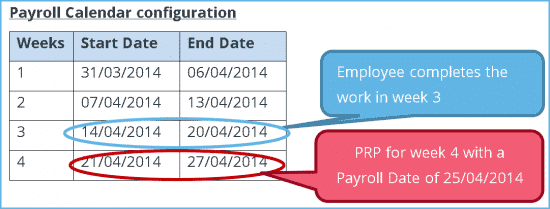

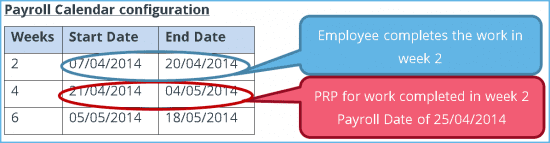

Weekly Paid Employee:

The work week runs from Monday to Sunday. The Payroll Date is the Friday following the week worked, so this means the employee is paid a week in arrears.

The employee is being paid in week 4, with a Payroll Date of 25/04/2014. The work week is Monday 14/04/2014 to Sunday 20/04/2014.

The Pay Reference Period (PRP) is Monday 21/04/2014 to Sunday 27/04/2014.

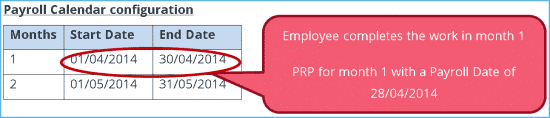

Monthly Paid Employee:

The work month runs from the 1st of the month to the end of the month. The Payroll Date is the 28th of the month, so this means the employee is paid at the end of the month they worked.

The employee is being paid in month 1, with a Payroll Date of 28/04/2014. The work month is Tuesday 01/04/2014 to Wednesday 30/04/2014.

The Pay Reference Period is Tuesday 01/04/2014 to Wednesday 30/04/2014.

2-Weekly Paid Employee:

The work fortnight runs from Monday to the second following Sunday. The Payroll Date is the first Friday in this period for the previous fortnight. This means the employee is paid on the Friday after the fortnight they have worked.

The employee is being paid in week 4, with a Payroll Date of Friday 25/04/2014. The work fortnight is Monday 07/04/2014 to Sunday 20/04/2014.

The Pay Reference Period (PRP) is Monday 21/04/2014 to Sunday 04/05/2014.

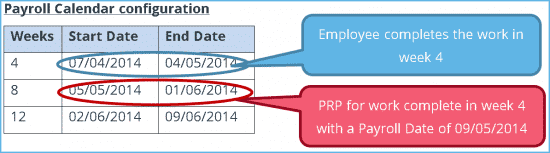

4-Weekly Paid Employee:

The work 4 weeks run from Monday to the fourth following Sunday. The Payroll Date is the first Friday in this period for the previous 4 weeks. This means the employee is paid on the Friday after the 4 weeks they have worked.

The employee is being paid in week 8, with a Payroll Date of Friday 09/05/2014. The work 4 weeks is Monday 07/04/2014 to Sunday 04/05/2014.

The Pay Reference Period (PRP) is Monday 05/05/2014 to Sunday 01/06/2014.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.