How do I configure the payroll calendar / Change the payroll date?

Article ID

11657

Article Name

How do I configure the payroll calendar / Change the payroll date?

Created Date

20th November 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How do I set up the payroll calendar for a new pay frequency or change the pay date of an existing one?

Resolution

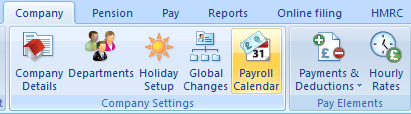

The payroll calendar is found in the “Company” tab:

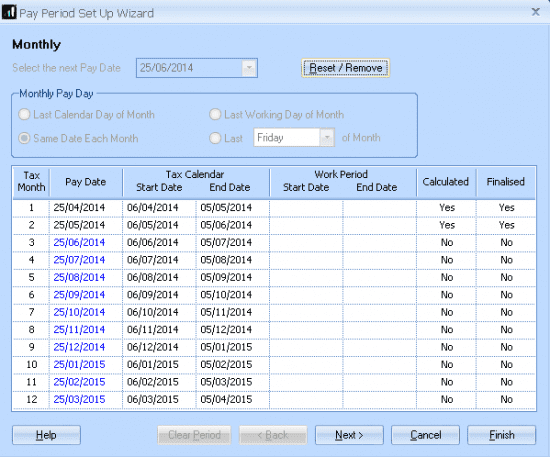

This is where you set the repeating pattern of your pay frequencies:

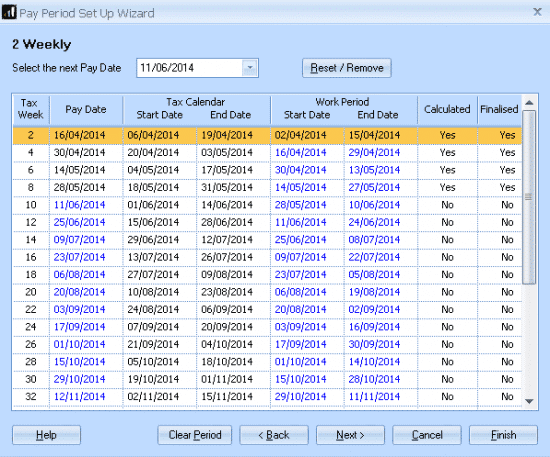

This screen lists the following details:

Tax Month / Week: This is the tax week or month number for the pay period.

Pay Date: This is when the employees actually receive their pay

Tax Calendar (Start & End Date): This is set out by HMRC and cannot be amended. The Pay Date used determines where this fits in the HMRC tax calendar to set the appropriate Tax Week / Month Number.

Work Period (Start & End Date): This is the period of work the employees are being paid FOR. This is completely independent of the tax calendar. To set this simply type in the “Start Date” of the 1st pay period and the other fields will fill in automatically.

Calculated / Finalised: This will show you where the payroll system is up to in the current tax year.

Setting up a new pay frequency

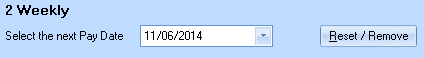

Click “Next” until you see the pay frequency you wish to set up.

Complete the field “Select the next Pay Date” with the date the employees will get paid on this frequency:

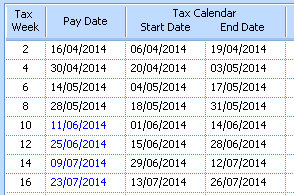

You will see the system populate the other pay dates in the list:

Finally, set the work period. Remember, this is supposed to cover the period of work the employees are being paid for. Set the start date and the system will automatically fill in the other dates:

Click “Finish”. The pay frequency is set up and ready to pay employees.

NOTE: Make sure employees are set to the correct pay frequency in their personal details > “Tax & NI tab”

Changing the pay date on an existing pay frequency

NOTE: It is best practice to reset the pay date AFTER you have finalised the previous period but BEFORE starting any work on the next.

Click “Next” until the pay frequency you wish to change is on screen.

Click “Reset/Remove” followed by “Reset”.

Type in the “Select the next Pay Date” field when the employees will next be paid on the NEW pay date.

Click “Finish”.

Removing an unused pay frequency

If you are wanting to remove an old, unused pay frequency, simply click “Next” until you see it on screen.

and then click the “Reset/Remove” button, followed by “Remove”.

This will remove this pay frequency from your payroll and you would not be able to pay employees on this basis until the pay dates are reconfigured.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.