Changing an employees NI rate - Business / Bureau

Article ID

11776

Article Name

Changing an employees NI rate - Business / Bureau

Created Date

13th January 2020

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

How do I change the NI rate for an employee part way through the tax year.

Resolution

You may find you need to change an employee NI rate part-way through the tax year. Most commonly this is because an employee has reached state pensionable age (spa) and provided an age exemption certificate. This allows them to move to NI rate C and stop making employee NI contributions.

Please Note: While this KB refers to changing an employee from NI rate A to NI rate C the exact same methodology is used to change between any appropriate NI rates.

Employees NI Rate changes in the current pay period

If the employee reaches SPA in the current pay period all you need to do is alter the NI rate in their personal details before saving variations or calculating payroll.

Double-click on the employee name in left-hand list.

Go to “Tax & NI” tab. Change the NI rate to “C-No Ee’s”. Click “Save”. The system will remind you to keep the supplied age exemption certificate on file.

Process your pay as normal, the employee will no longer pay NI but the employers NI will continue as normal.

Employees NI rate changed in a previous pay period

If you are processing a change in NI rate retrospectively, ie. you have been provided with the certificate of age exemption late, you will need to perform an NI adjustment. Before doing this we recommend you create a backup of your current data.

PLEASE NOTE: An NI adjustment should be run BEFORE you save any variations or calculate payroll in the pay period. If you have already saved or calculated you will need to UNDO the employee before proceeding.

First, as above, go into the employee details, “Tax & NI” tab and set the NI rate to “C-No Ee’s”. Click “Save” then “Close”.

Then, click once on the employee name to highlight them in the list, go to “Employee” (tab along the top of the screen) > “NI Adjustment”

Click “Yes” to the warning prompt.

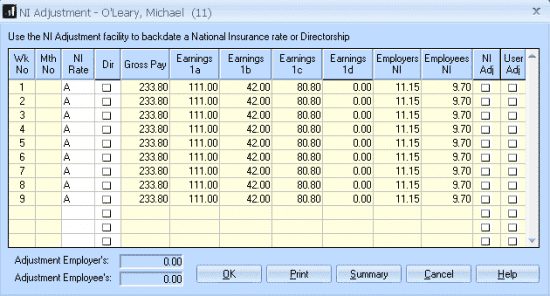

You will then see the NI adjustment window, this details the NI calculation, per pay period, for the employee:

In this example the employee has just given us the certificate of age exemption, this should have been applied since week 3.

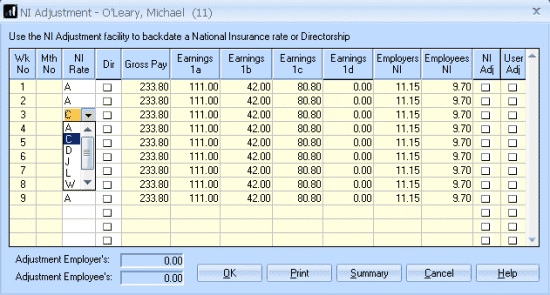

Click into the “NI Rate” column for the appropriate week/month and select the rate you want to be applied:

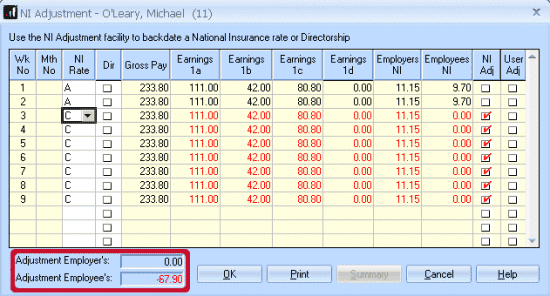

You will then see the system recalculate the NI on all the following periods, at the foot of the window you will see the adjustment that will be included in the employee next pay:

Click “OK” and continue with payroll as normal.

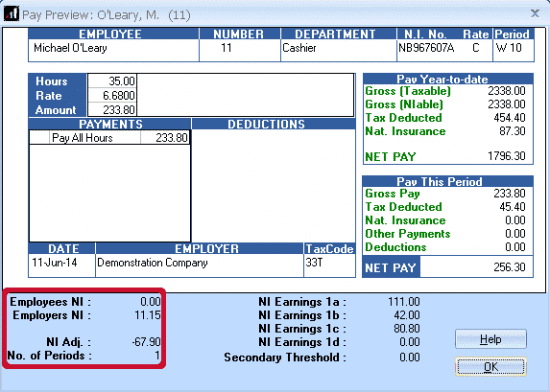

Adjustment as it shows on the payslips preview:

PLEASE NOTE: An employee changing from NI rate A to C will have the new rate applied for the WHOLE of the period the change applied. You do not need to split the NI calc over 2 rates for the same pay period ie. 1st half of the month on rate A, 2nd half of the month on rate C. The correct calculation would be the whole month on rate C.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.