Configuring and using Loans

Article ID

12082

Article Name

Configuring and using Loans

Created Date

6th April 2018

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

An employee has received a company loan, can I process this through payroll?

Please note: This KB does not cover Student Loans. These are handled differently in the software. This KB focuses on handling company loans eg. paying back a wage advance or season ticket loan to pay for a train or bus pass. For details on student loans please click here.

Resolution

In the payroll, gross pay is made up of Salary, Hourly Rates, Payments and Deductions, Attachment of Earnings Orders, Pensions and Loans.

In this KB we will explain how to create Loan repayment types.

For details on configuring Salary, Click here

For details on configuring Hourly rates and Overtime Factors, Click here

For details on configuring Attachment of Earnings Orders, Click here

For details on configuring Pensions, Click here

For details on configuring other payments or deductions, Click here

Loans

Loans, like payments & deductions, need to be set up at company level first and then allocated to your employees.

They are set up like a normal Payment/ Deduction (see KB: 12081 Click here ) with Type set to Loan but allocated to employees in a slightly different place.

Allocating a Loan

To allocate a Loan to an employee, in this example we’ll use a Season Ticket Loan:

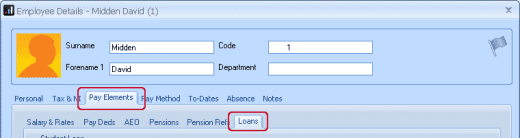

• Double-click on the name of the employee you want to allocate the loan to. You will have the employee list down the left-hand side of the main payroll screen.

• Click Pay Elements and then Loans

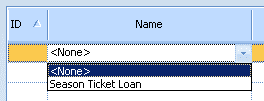

• Click on the text <None> in the grid, and then click on the drop down arrow which appears. The drop down list will show all the loans set up at the company level.

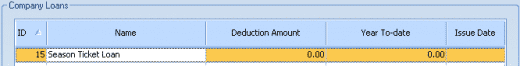

• Select Season Ticket Loan and the rest of the row will be completed for you.

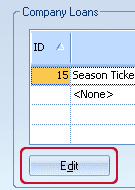

• Click the Edit button

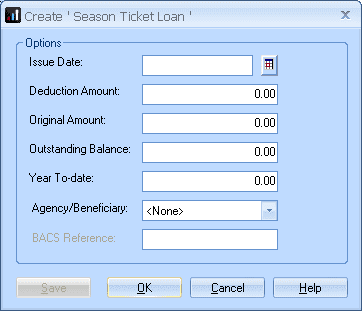

• Enter the details of the loan into the Create Season Ticket Loan screen.

• Enter today’s date in the Issue Date field

• Deduction Amount is the amount you want to deduct each pay period: enter ‘25.00’

• Original Amount is the full amount of the original loan: enter ‘1000.00’

• Outstanding Balance is how much the employee has left to pay: enter ‘1000.00’

• Year-To-Date is what they have paid towards the loan so far. This field is populated as you Calculate and Finalise each payroll

• Click OK, then Cancel

The loan is now in place when calculating payroll. With each period the software will take £25.00 off the employee to repay this loan. The Outstanding balance will reduce by the value of the deduction each period and stop once the balance reaches zero (0.00).

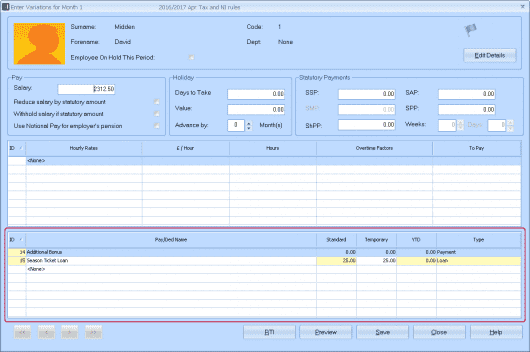

When working through Enter Variations you will see loans grouped with the other payments/deductions in the employees Pay/Ded list:

Like with other Payments & Deductions, you can change the value in the Temporary column if you wish to raise or lower the amount processed against the loan this period.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.