Business Tax- Add Groups and Consortium entry (CT600C) to surrender/claim loss

Article ID

business-tax-add-groups-and-consortium-entry-ct600c

Article Name

Business Tax- Add Groups and Consortium entry (CT600C) to surrender/claim loss

Created Date

28th March 2024

Product

Problem

IRIS Business Tax- How to add a Groups and Consortium entry (CT600C) to allocate and surrender a loss

Resolution

The IRIS help link here for the full guide on how to surrender/claim a loss against profits. If you get a warning or error box appear then use the KB search bar for an answer.

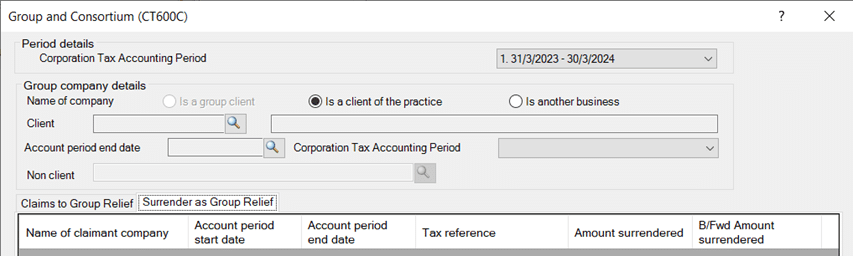

1. Load the relevant company and go to Data Entry | Groups and Consortium (CT600C). Two tabs will show – ensure you select the right option

Claims to Group Relief TAB- Profit making company which is receiving the loss from another company

Surrender as Group Relief TAB- Loss making company which is surrendering(transferring) the loss to another profit company

Period details

2. Select the Corporation Tax accounting period to which the return relates.

Group company details

In order to include information regarding the surrendering / claimant company the Group company details section must be completed.

3. Where the client selected in the main toolbar is part of a Group Client and has also been created within IRIS the radio button will be set to Is a group client by default, otherwise this option will be disabled.

4. Click the Client magnifying glass to select the client; this will display the parent and subsidiary client(s) within the Group Companies window.

5. To select a limited company client that is already setup in the IRIS database, select the Is a client of the practice option and then click the Client magnifying glass to select the client; this will display the Client Browser screen.

6. To setup a business that is not an IRIS client select the Is another business option, this will disable the options for Client as well as the Account period end date and the Corporation Tax Accounting Period fields.

7. Click the Non client magnifying glass to display the Businesses Who Are Not Clients window. This screen displays a list of all businesses who are not a client (with an identifier) within the database.

Step 1 – Allocation of Group Relief – Claimant Company

To allocate the surrendered losses from the surrendering company, click the magnifying glass in the Amount field for the surrendering company. This will display the loss allocation window for the claimant company. Use this screen to allocate the losses from the surrendering company to the claimant company.

IRIS will perform validation for both the surrendering company and the claimant company to ensure that the losses being surrendered are not greater than the available losses for the CTAP. Where IRIS detects that the loss surrendered / claimed is not valid a warning message will be displayed with the appropriate information.

The first column lists the relief headings from the CT600C 2: Amounts surrendered as group relief.

- The Profit / Loss will display the net trading profit /loss for the selected IRIS database client(s)

- Trading losses

- Excess non-trade capital allowances over income from which they are primarily deductible

- Excess non-trading deficit on loan relationships

- Non-trading losses on intangible fixed assets

- Excess charges over profits

- Excess of Schedule A losses over profits

- Excess of management expenses over profits

The second column will display the information for the claimant company; including the Net trading profit and any loss relief which has been allocated to it from any surrendering company.

To add / edit the split of the loss relief allocated to the claimant company select the surrendering company in the main Groups and Consortium (CT600C) screen and click

the magnifying glass in the Amount field for the surrendering company. Enter the amount(s) into the selected column.

Box C1 will automatically be completed by the system and entered in box 36 on the CT600.

- The details for the IRIS claimant company and the IRIS surrendering companies will be simultaneously updated.

If there are any further surrendering companies you must repeat this process.

Select C1B if the trade carried on in the UK through a Permanent Establishment.

Select C1C if the company is a non-resident company other than those covered by C1B.

Authorisation

Complete the details in this section if a simplified arrangement is in force, or if a copy of consent for each surrendering company is to be attached tick the box Notice of consent to be attached.

Step 2 – Surrender as Group Relief

Use this tab to enter details to appear in Part 2 of the CT600C.

If this tab is being completed, IRIS Business Tax will verify that the client in the main toolbar is the surrendering company, the details for the claimant company should therefore be added so that the appropriate loss allocation can be specified and updated between all group companies.

Allocation of Group Relief – Surrendering Company

To allocate the surrendered losses to the claimant company, click the magnifying glass in the Amount field for the claimant company.

This will display the loss allocation window for the surrendering company. Use this screen to allocate the losses from the surrendering company.

- IRIS will perform validation for both the claimant company and surrendering company to ensure that the losses being surrendered are not greater than the available losses for the CTAP. Where IRIS detects that the loss surrendered / claimed is not valid a warning message will be displayed with the appropriate information.

The first column lists the relief headings from the CT600C 2: Amounts surrendered as group relief.

The Profit / Loss will display the net trading profit / loss for the selected IRIS database client(s).

- Trading losses

- Excess non-trade capital allowances over income from which they are primarily deductible

- Excess non-trading deficit on loan relationships

- Non-trading losses on intangible fixed assets

- Excess charges over profits

- Excess of Schedule A losses over profits

- Excess of management expenses over profits

The second column will display the information for the surrendering company; including the Net trading loss and any loss relief which it has surrendered to the claiming company.

To add / edit the split of the loss relief allocated to the claimant company select the claiming company in the main Groups and Consortium (CT600C) screen and click the magnifying glass in the Amount field for the claimant company.

Box C2 will automatically be completed by the system.

- The details for the IRIS surrendering company and the IRIS claimant companies will be simultaneously updated.

If there are any further claimant companies you must repeat this process.

Authorisation

Complete the details in this section if a simplified arrangement is in force, or if a copy of consent for each surrendering company is to be attached tick the box ‘Notice of consent to be attached’.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.