Business Tax: Box 865 Repayment of Corporation tax

Article ID

business-tax-box-865-repayment-of-corporation-tax

Article Name

Business Tax: Box 865 Repayment of Corporation tax

Created Date

25th October 2021

Product

Problem

IRIS Business Tax: How to fill Box 865 Repayment of Corporation tax

Resolution

How to fill in 865: Data Entry, Calculation, Tax Reconciliation, Enter figure in box 595, which fills in 605 and Ok. This fills in 865 on the CT600. It only picks up the value entered in 595.

The Rules: On CT600 Box 865 will only be filled in if the company has a ‘Tax already paid’ amount in box 595 and it also exceeds the ‘Tax due’ amount in box 600 OR there is no value in box 600.

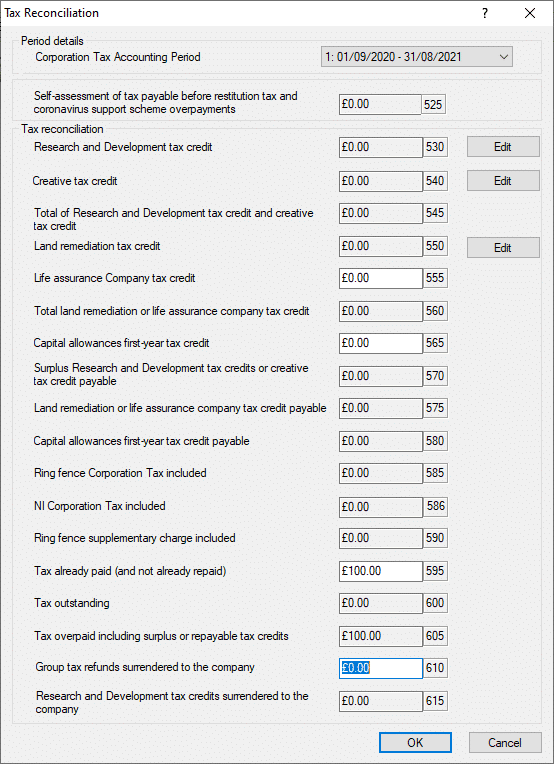

When you fill in 595: So if box 600 still has a value in it (tax due) then 865 will be empty

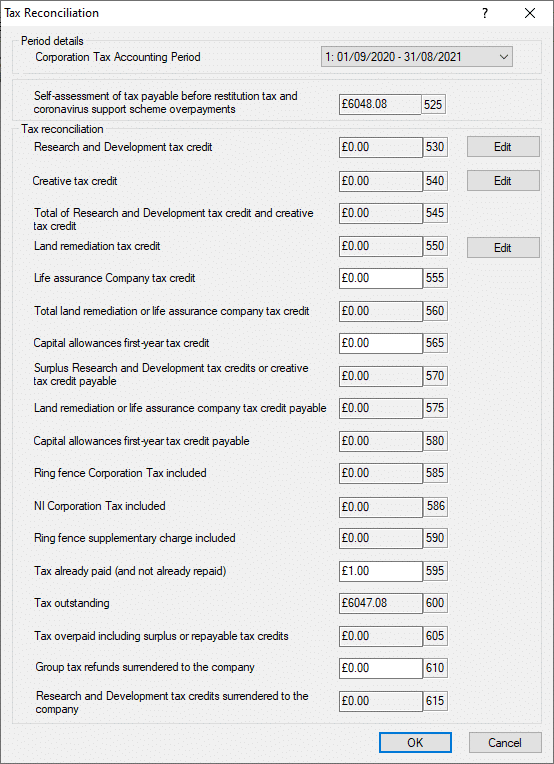

And if instead 605 now has a value (tax overpaid) rather then 600 then this fills in 865. Note only the value from 595 will be used on 865.

For example: it may show like this and the value in 595 will show in 605 (and then onto 865)

If 595 is entered but it doesn’t exceed 600 then 605 and 865 will be empty

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.