Business Tax: How to claim SME R&D Allowance or Expenditure Capitalization

Article ID

business-tax-claim-sme-rd-allowance-or-expenditure-capitalization

Article Name

Business Tax: How to claim SME R&D Allowance or Expenditure Capitalization

Created Date

12th August 2021

Product

Problem

How do you claim SME R&D Allowance or Expenditure Capitalization in IRIS Accountancy Suite Business Tax

Resolution

In IRIS BT a SME R&D Allowance or Expenditure Capitalization is known as ‘R&D Allowance’:

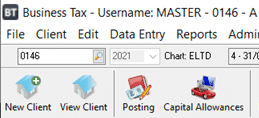

- Select “Capital Allowances”

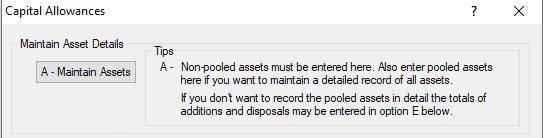

- Select “A – Maintain Assets”

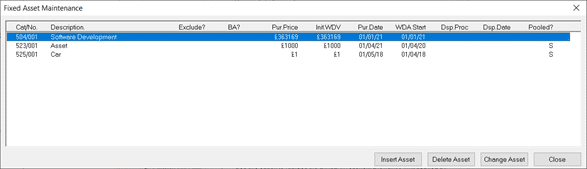

- Insert or Change an asset

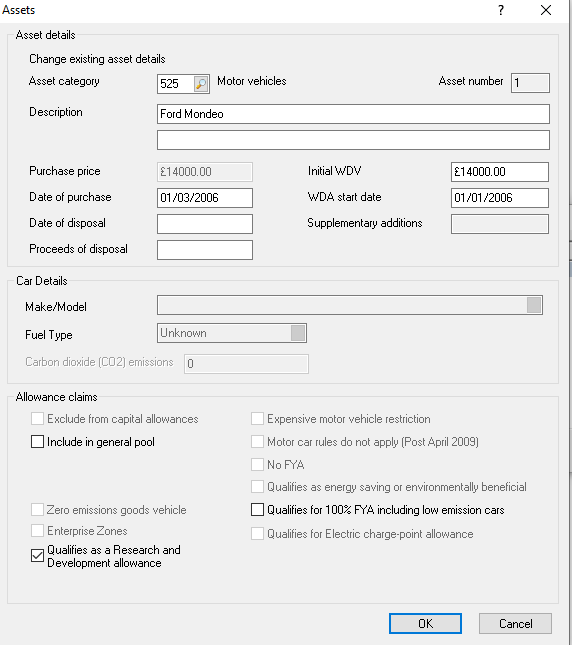

- Tick the box on bottom left – ‘Qualifies as a R&D Allowance’. In the Tax comp under the Trade Profit (loss) section it will appear as a ‘less’ amount value under the title Capital Allowances. This will usually automatically fill in box 725 and 760 on the Tax return (for LTD)

- ‘Qualifies as a R&D Allowance’ tick box will claim the whole capital allowance WDA amount of the asset entered

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.