Business Tax- CT600L and R&D SME L167+ L168 for PAYE and NIC Liability

Article ID

business-tax-ct600l-and-rd-sme-l168-for-paye-and-nic-liability

Article Name

Business Tax- CT600L and R&D SME L167+ L168 for PAYE and NIC Liability

Created Date

8th June 2022

Product

Problem

IRIS Business Tax: CT600L and R&D SME L167 and L168 for PAYE and NIC Liability (and L166)

Resolution

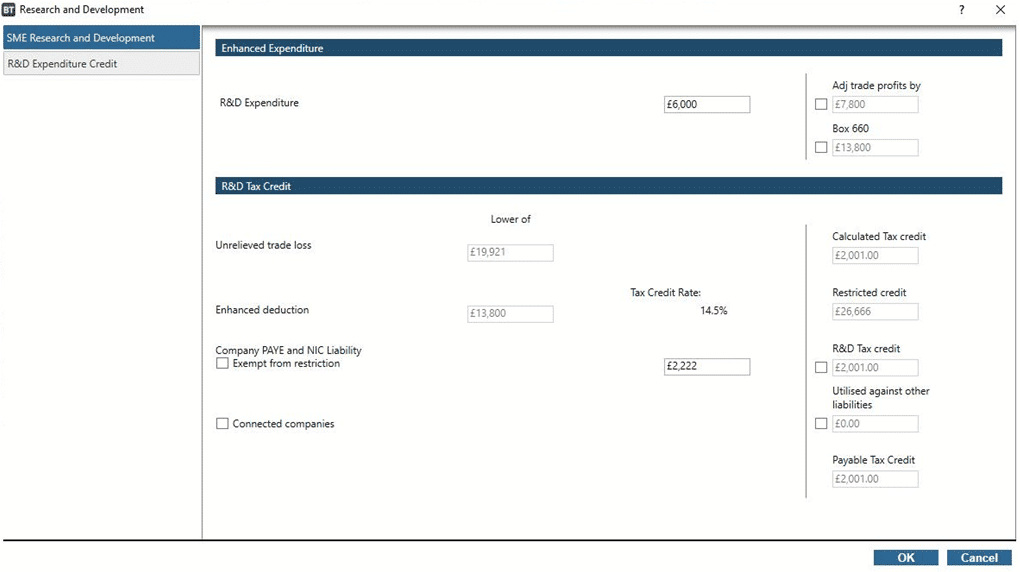

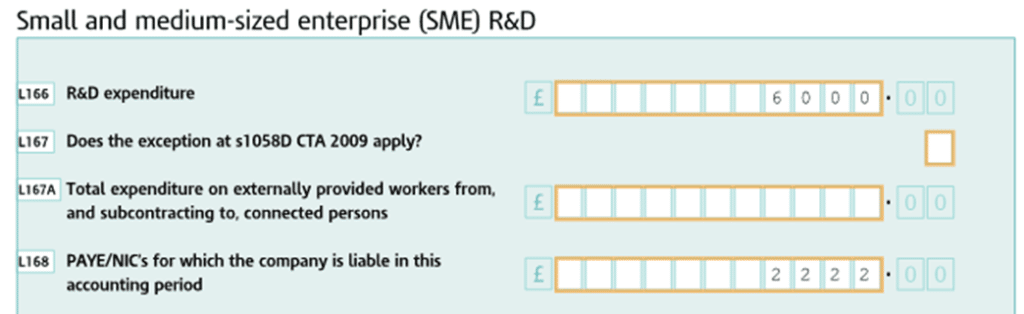

Data Entry | Research and Development CT600L | Company PAYE and NIC Liability – you need to untick the ‘Exempt from Restriction’ and fill in the box on the right side which populates L168. If its doesn’t show on L168 then tick box ‘Exempt from Restriction’ and then check the CT600 and also read the rules below:

NOTE: The option to fill in Box L168 is period based. The PAYE and NIC liability is used to restrict the R&D Tax credit but the restriction does not apply to periods starting before 01/04/21.

Research and Development, then go to SME Research and Development, then fill in the box ‘Company PAYE and NIC liability‘. For example this is a 2022 period – the option for ‘Company PAYE and NIC liability’ box will then show and the value entered will show on box L168. If the period is too early then the box ‘Company PAYE and NIC liability’ will not appear. This is following HMRC rules.

Box L167: The same period rules applies for L167 on why its ticked or unticked (which is done automatically). For example: periods starting before 01/04/21, L167 is ticked by default.

NOTE: If the LTD is multi trade and you have not allocated the trade values into each one (OR there’s only ONE trade entry)- then L166 and L168 may not be populated with any calculated values. BT will warn you when you load this client that no trade has been allocated.

These 2 images are after 01/04/2021 (if not ticking Exempt from restriction)

When you fill in the Company PAYE NIC liability but the box value keeps vanishing. Run a DRAFT tax return, go to L168 and click on that box. This brings up the same SME screen. Fill in that box again and OK – run the draft return again

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.