Business Tax: How to enter SME R&D and RDEC values Pre/Post 2019

Article ID

business-tax-how-to-enter-sme-rd-and-rdec-values-pre-post-2019

Article Name

Business Tax: How to enter SME R&D and RDEC values Pre/Post 2019

Created Date

23rd July 2021

Product

Problem

IRIS Business Tax - How to enter SME R&D and RDEC entries in Pre and Post 2019 periods?

Resolution

In 2024/2025 IRIS has revised the SME R&D and RDEC screens which affects post 2024 returns (released with the IRIS version 24.2.0). IRIS has been updated to accommodate changes resulting from the merger of SME tax relief and the Research and Development Expenditure Credit (RDEC), effective for accounting periods starting on or after April 1, 2024.

Dates straddling a year credit calculation: For example for a period straddling period for ‘2023’ the R&D tax credit is calculated based on the lower of enhanced expenditure and loss for EACH period with the entire CTAP.

Key Features of the Merged Scheme: A new Tab is added: ‘Additional information’ (Alongside the RDEC and R&D Tabs) which shows cap restriction calculations for PAYE/NIC which are being automatically applied for claims as per HMRC rules: this cap on PAYE and NIC liabilities is now shared between RDEC and SME R&D claims. (Note: these calculations CANNOT be overridden and you can only edit the RDEC/R&D ‘tax credit’ value when you first enter the relevant expenditure). The Enhanced Tax comp will show a new line ‘PAYE and NIC cap restriction’.

In 2020/2021 IRIS revised the design of the SME R&D and RDEC entry screens which affected post 2019 returns. However if you are running a pre 2019 return you will still need to use the original methods of entering data.

There are two rules: PRE 2019 and POST 2019, please read the relevant one below:

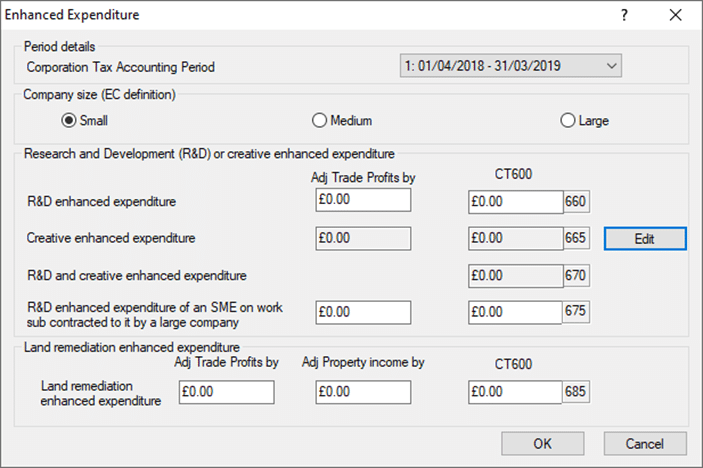

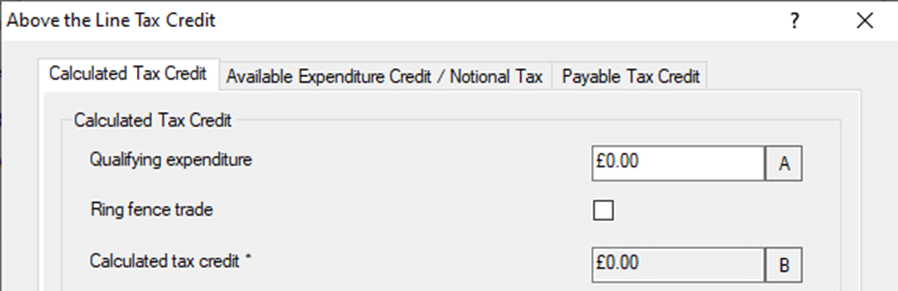

Pre 2019 SME R&D and RDEC data entry

SME R&D: Data Entry | Enhanced Expenditure | ADJ trade profits by – qualifying expenditure multiplied by 130% | CT600 – qualifying expenditure multiplied by 230% The tax credit claim figure will be the lower of the CT600 figure entered in Enhanced Expenditure and the financial trading loss made in the year on the computation, multiplied by 14.5% (post April 2014 rules). Go to Data Entry | Calculation | Tax Reconcilliation | Edit next to box 87/545 – enter the 14.5% tax credit claim at the very top.

RDEC: Data Entry | Calculation | Tax Reconcilliation | Edit next to box 87/545 – Click ‘Above the line tax credit’ details box. Enter the Qualifying Expenditure in Box A. BT will calculate the rest. We have also provided options to adjust the values (Box C and D etc ).

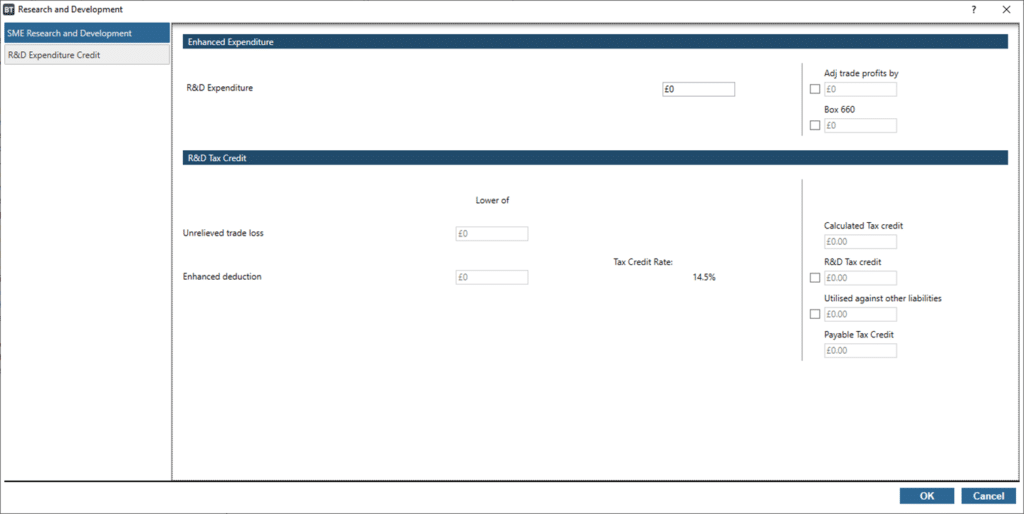

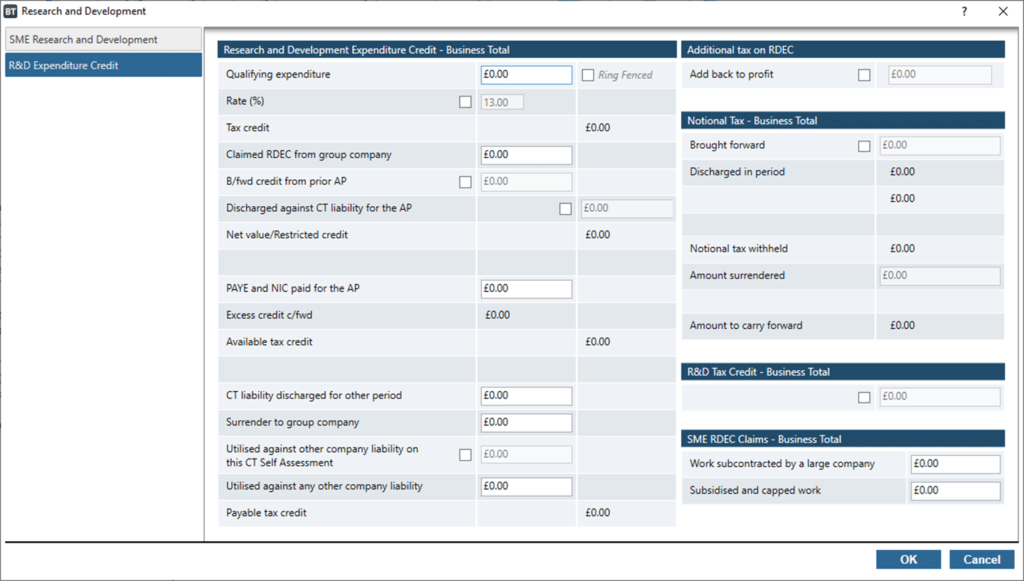

Post 2019 SME R&D and RDEC data entry

- Load the Client in BT and select the correct period

- On left side – Research and Development (CT600L)

- On the top left – choose the tabs either SME R&D and/or R&D Expenditure Credit(i.e RDEC). For Post 2024. An ‘Additional Information’ tab is added for cap restrictions on PAYE/NIC.

- Only enter the value on the ‘Expenditure’ box. BT will auto calculate the credit (if permitted)

- We have provided override options etc to adjust the values

- OK to save

SME R&D screen – You can only claim the Tax Credit if the company is making a loss.

R&D Expenditure Credit (RDEC) screen

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.