Business Tax- How to populate Box 659/657 SME R&D Expenditure?

Article ID

business-tax-how-to-populate-box-659-sme-rd-expenditure

Article Name

Business Tax- How to populate Box 659/657 SME R&D Expenditure?

Created Date

18th July 2023

Product

IRIS Business Tax

Problem

IRIS Business Tax- How to populate Box 659 and 657 SME R&D Expenditure?

Resolution

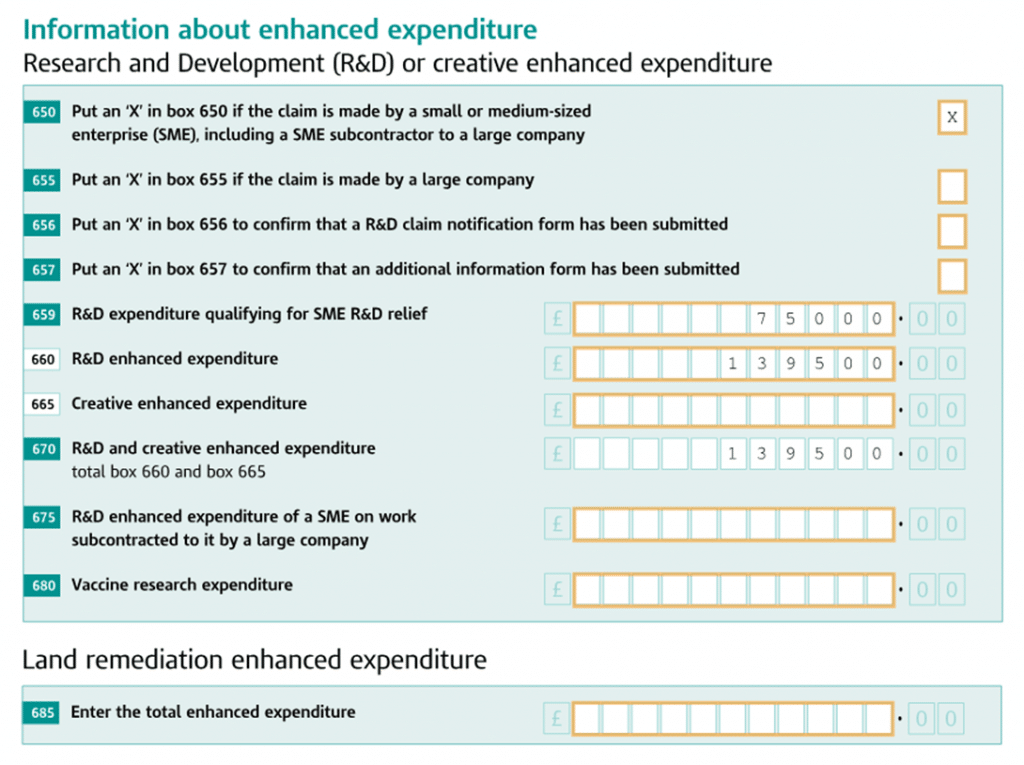

Load the Client and relevant period – go to the SME R&D screen and fill in R&D Expenditure box ; this should fill in Box 659 IF it meets the HMRC period rules (see below)

If the CT600 Box 659 is showing up empty and it should show the R&D expenditure value

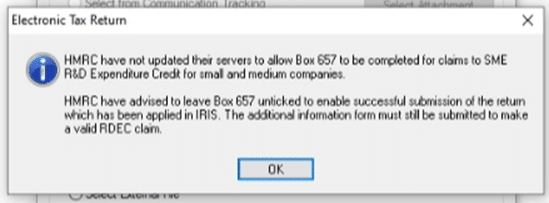

Box 657 Additional information place a X: This is only linked to the SME R&D (not RDEC), tick the box ‘Additional information has been submitted’. If you enter a RDEC claim and then go to the SME section to tick box 657 you will get this warning when generating (so untick 657) and add instead as a external PDF:

HMRC: Box 659 only requires completing for CTAP starting on or after 1/4/2023 (it will be empty if before this date). This is based on the HMRC CT Schema v1.991 which states this date rule. If you have any queries on this then you will need to contact HMRC support.

If before 01/04/2023: You can still submit the return even if box 659 is empty

This example below is dated after 01/04/2023 which shows 659 populated.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.