BT/PT - How can wear and tear allowance be entered?

Article ID

ias-10398

Article Name

BT/PT - How can wear and tear allowance be entered?

Created Date

5th April 2012

Product

IRIS Business Tax

Problem

IRIS Business Tax and Personal Tax - How can wear and tear allowance be entered?

Resolution

In BT, Users are required to:

1. Log on to IRIS Business Tax and select the client

2. From the Edit menu select Posting.

3. Click on the ‘+’ sign to the left of Property expenses and select specific posting.

4. Enter the description and the amount, if it is a long accounting period you should also enter the date so the posting can be applied to the correct CTAP.

Wear and tear will not usually be included in the accounts so leave the Schedule D I field unticked.

In PT, Users are required to:

- Load PT client and the year

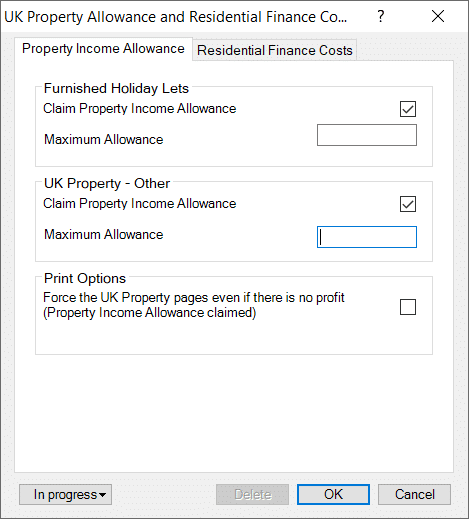

- Income| UK land and property | UK property allowance and residential finance cost | Property income allowance | UK and other property tick the box and enter the amount claimed

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.