Personal Tax- Foreign Tax Credit Relief is missing or a less relief amount

Article ID

ias-10790

Article Name

Personal Tax- Foreign Tax Credit Relief is missing or a less relief amount

Created Date

6th December 2012

Product

IRIS Personal Tax

Problem

IRIS PT- Clients have entered foreign dividend income which total's less than £300 but the foreign tax credit that needs to be claimed is not showing as the foreign pages are not populated and the grossed up amount is showing in TR3 box 5.

Resolution

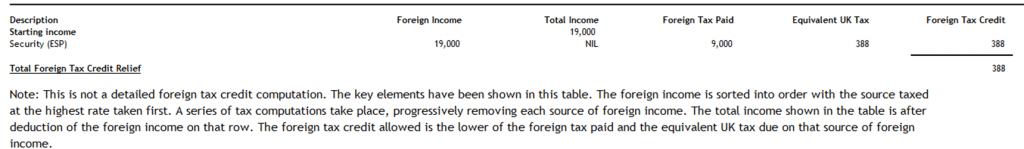

1. Load Personal Tax and choose the client – Reports and Run the Foreign tax credit relief comp and Foreign tax credit relief CG comp. This explains if the relief value is less then you expected as it has to use the lower UK tax value (Even using 0 value if there is no UK Equivalent).

As PT cannot yet produce a full breakdown of the Tax relief (apart from the Tax comp) please read this HMRC guide: https://www.gov.uk/government/publications/calculating-foreign-tax-credit-relief-on-income-hs263-self-assessment-helpsheet

2. If the relief value is missing: Go to the Foreign section, Choose Additional Information. Tick force dividends of £300 or less onto the Foreign Pages. The foreign pages will then be populated and the Foreign Tax Credit will show on the first page.

3. The Tax comp will show the permitted relief amount BUT the Schedules of data report is designed to only show the full unrestricted Relief and may not match the Tax comp.

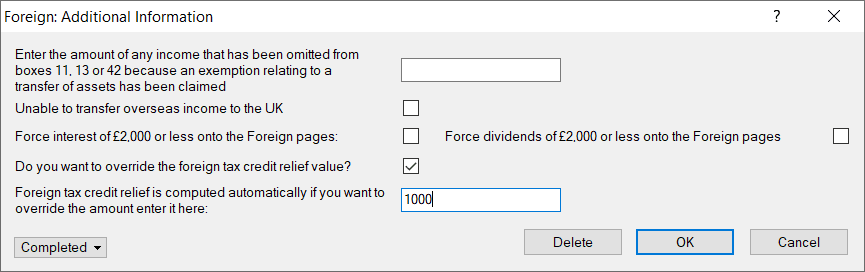

4. If you disagree with the Foreign tax relief value, then tick the override option and enter the value you want

If the Capital Foreign Relief is being restricted – but its showing full relief on the CG Foreign relief tax comp, there is another HMRC rule being applied from entries in Gift Aid and BRB: Link below. The CG comp may show this:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.