Personal Tax- Property Mortgage interest/Residential finance Cost Relief is missing/wrong

Article ID

ias-12844

Article Name

Personal Tax- Property Mortgage interest/Residential finance Cost Relief is missing/wrong

Created Date

27th June 2018

Product

IRIS Personal Tax

Problem

IRIS Personal Tax: What is mortgage interest/Residential finance cost rate restricted relief and when will it appear on the computation? UKP2 Box 44

Resolution

This HMRC legislation was brought in from 2018, whereby 25% of the Expense type 16 or 17 for a property will be taxed at the basic rate of 20%. HMRC link: https://www.gov.uk/government/publications/restricting-finance-cost-relief-for-individual-landlords/restricting-finance-cost-relief-for-individual-landlords

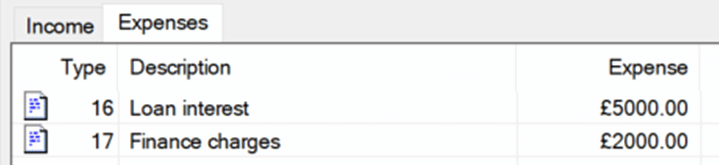

UK Land and Property – Expenses tab- enter in Type 16 or 17 expense types and values.

The calculation of the Mortgage interest/finance cost relief is based on these three rules:

1. There needs to be enough profit for the property.

2. There needs to be enough taxable non-savings income.

3. The calculation will also be restricted if there is income tax relief. If it does not show that year, then it will be carried forward to the next year.

You can find a detailed report under Reports | Residential Finance Costs Computation and show on UKP2 box 44. This will explain the calculation (also the relief can be automatically partially restricted and the rest carried forward under certain rules). If the total loan amount is less then expected – read below.

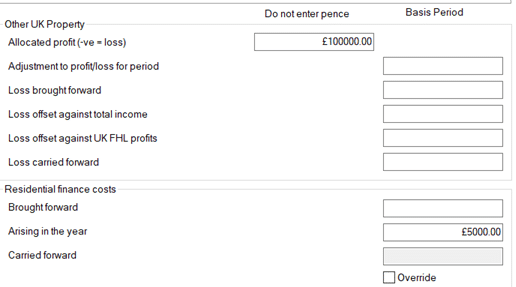

Most cases where its only giving partial relief OR its missing the relief: this is usually related to the clients income amounts where it has not triggered the first 2 rules – So check for losses carried forward which can affect the calc and as a test just increase the clients property/and or taxable non savings income and then run the Residential Finance Costs Computation. You may now see the Relief come though. Also how the ‘Adjusted profit’ and ‘Allowable Finance cost’ fields are calculated:

Why the ‘Adjusted profit’ calculation is less then expected? This is the total of all property income (post expenses) and is automatically reduced/adjusted by losses and brought forward losses from past years (for example go to ‘UK Property losses’ the losses values here will adjust the ‘Adjusted profit’).

Why the ‘Allowable Finance cost’ total is higher then expected? This is the total of finance costs of the current year AND carried forward finance costs of past years which is why its higher then the current year total (for example: current finance costs total is £10,000 but it shows as £10,500). PT will utilise the maximum amount of combined finance costs (current and past) up to the limit of the ‘Adjusted Profit’.

Partnerships: This relief rule also applies on Partnerships with property income, open the Partnership, Land and property tab, there has to be a Profit value entered AND the residential relief entered here. The Residential Finance Costs Computation also lists the values being used or not. Also note if you move the income into Land and Property, it will not visually show on the ‘TPV summary screen’ but will still show on the Tax comp/Return.

Note: If you claim the £1000 property allowance it will not calculate any Residential claims as it overrides all expense claims. Untick it to see the change.

Edit/restrict the relief value: Users cannot manually restrict/edit the interest relief in the year based on these rules (eg you want to reduce/stop relief in the year and carry more of it forward into next year). The only value users can restrict is the ‘carried forward’ amount – under property allowances and residential tab.

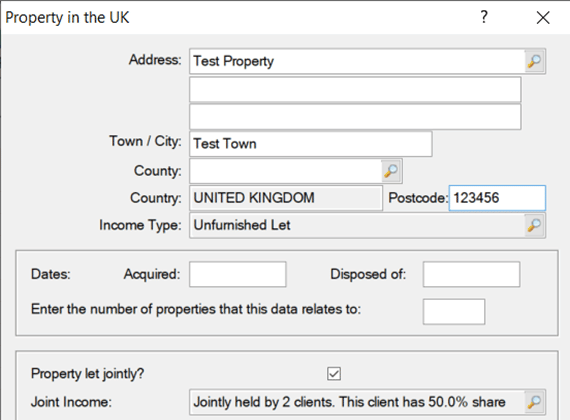

Relief is less then expected even when you meet the 3 HMRC rules– Open the property and check the Jointly held property % share. If its not at 100% then the given relief will be reduced by this % value.

Relief is missing even when you meet the 3 HMRC rules– Find the Type 16(or similar) Loan under Expenses and delete it. Then add it back in again. Run the Residential Finance Costs Computation and Tax comp again. If the property is jointly held – also remove the joint and % share and then add it back in again.

BT transfer to PT Partnership Property– In PT, TPV, STP, Open the relevant partnership period, open the Land and Property tab and enter in the PROFIT and Residential Finance Cost Arising in Year values here. (Do not enter profit under Trading income, if it is appearing there, then move it to Land and Property)

I have multiple properties each with own Loan interest entry which total xxxx. The Residential Finance Costs Computation totals a reduced value, why? Load the property screen so you can see all your property entries, open each one – check if its been set as JOINT/or set at a % value e.g. 50/50. If you see this then then that expense is shared between multiple clients which is why the total costs show a lower value.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.