P11D- 3001 7790 P11d NIC payable must equal 14.53% of the total benefit

Article ID

p11d-3001-7790-p11d-nic-payable-must-equal-14-53-of-the-total-benefit

Article Name

P11D- 3001 7790 P11d NIC payable must equal 14.53% of the total benefit

Created Date

20th April 2023

Product

Problem

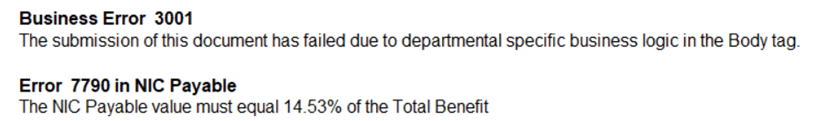

IRIS P11D- 3001 7790 P11d NIC payable must equal 14.53% of the total benefit

Resolution

Once updated to IRIS version 23.1.0, when submitting a P11D – you are getting this warning however the calculation for NIC is still correct.

This has been fixed – please update to IRIS version 23.1.5 (released 23/5/2023), if you get same error then regenerate and submit again.

If you still get the warning then follow these steps:

1.Do you have any P11d entries/car benefits for clients which is creating the NIC Class 1A? Go to ‘Reports’ and run the ‘Class 1A NIC’ which shows which person has the NIC 1A.

2. IF there are any entries which calculate NIC 1A eg like a Type 28 benefit or a Car entry, note down the title and values etc then delete them – save and close the P11D

3. Load the P11D and add back in the benefit/car entry with same values again. If Class 1A is needed then tick Y in the box.

4. Now regenerate the electronic P11D again and submit.

5. If you get the same error again – please check again ALL benefit and CAR entries which trigger Class 1A and follow the steps from point 2) and 3) again.

6. Users have reported to us they have done all the steps but still get the 7790 but when they regenerated and tried later (next day etc) it was submitted with no issues. So remember to regenerate and try later.

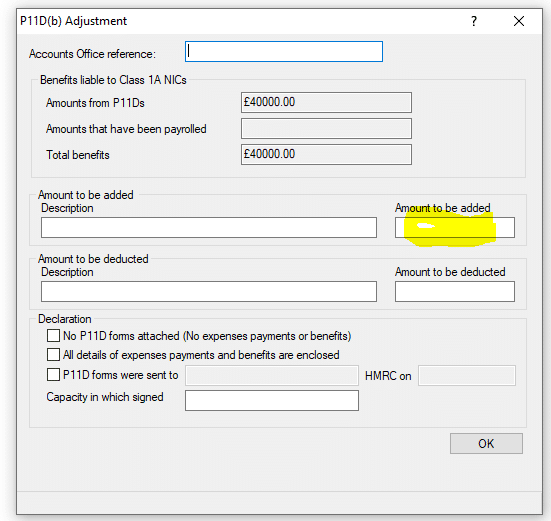

7. In addition: Check if you have made an ‘Adjustment to be added’ (on the P11DB) which affects the total benefit and can cause the error. Our Dev team is looking into this as well. If an urgent submission then as a workaround: Remove the adjustment entry and for the specific employee/director add in a expense type 0 with the value.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.