P11D/Personal Tax- Invalid National Insurance Number

Article ID

p11d-personal-tax-invalid-national-insurance-number

Article Name

P11D/Personal Tax- Invalid National Insurance Number

Created Date

11th May 2023

Product

IRIS P11D, IRIS Personal Tax

Problem

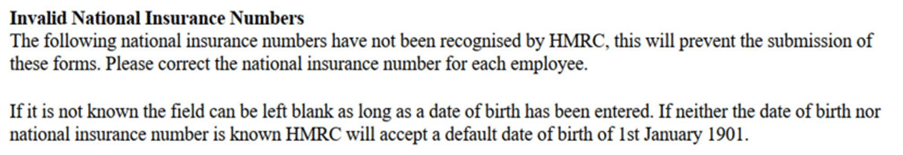

IRIS P11D/Personal Tax- Invalid National Insurance Number

Resolution

Known Issue and fix: If a client has a PREFIX of ‘NJ’, please first ensure you are on IRIS version 23.1.5 and then install this download

In PT – Go to Client, View and Tax tab- check the NI code of the client and it meets the HMRC rules. You can delete it and enter it back in and then regenerate.

In P11D – top left click the mag glass against company ID, find company and View – Related and Involvements, Find the employee/director and view it. Tax tab- check the NI code of the client and it meets the HMRC rules. You can delete it and enter it back in and then regenerate.

IRIS uses the HMRC rules on how NI codes are arranged, if it doesn’t meet the HMRC formatting rules then this error will appear. HMRC rules on NI code:

https://www.gov.uk/national-insurance-rates-letters/category-letters

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.