Personal Tax- Brought Forward Trade loss NOT being used against other income?

Article ID

personal-tax-brought-forward-trade-loss-not-being-used-against-other-income

Article Name

Personal Tax- Brought Forward Trade loss NOT being used against other income?

Created Date

11th January 2023

Product

Problem

IRIS Personal Tax- Brought Forward Trade loss NOT being used against Other income? it keeps being carried forward to next year

Resolution

HMRC rule: You can only use the losses and offset them against other income in the same year (which is why the year you are on only allows use the max amount of the current year loss) and the rest of the b/f loss amount will be carried forward until the trade/partnership has a gain.

If you want to use it in prior year where the loss came from – Change year where it originally came from – then use the loss against other income and send amended tax return. Or if you or your client believes there will be a trade/partnership gain in a future year then leave the loss to be carried forward.

NOTE: When you make a entry to use loss or edit it – always remember to run the TRADE computation as this refreshes the systems and picks up the latest values. Do not run the tax comp straight away.

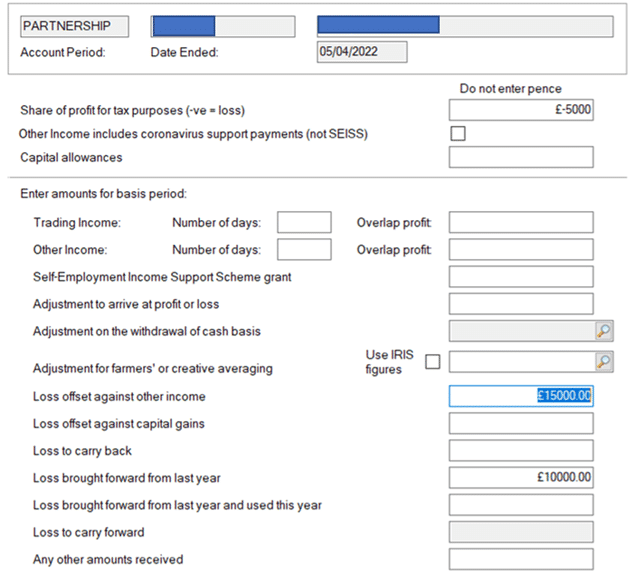

NOTE: PT will not block you trying to claim the amount you want to use (see the £15000 entry- 5K from current year and 10K brought forward) but when you run Trade and Tax comp – it will apply the HMRC rule and only use the current year loss of £5000 to offset against other income. The b/f loss £10000 will be carried forward to next year.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.