Personal Tax- Clogged Losses and connected persons

Article ID

personal-tax-clogged-losses-and-connected-persons

Article Name

Personal Tax- Clogged Losses and connected persons

Created Date

31st December 2021

Product

Problem

IRIS Personal Tax- Clogged Losses and connected persons - how to work with them?

Resolution

Unfortunately, IRIS Personal Tax is not currently designed to deal with losses to connected parties automatically; This implementation of this advanced feature is currently with our software development team for a future enhancement.

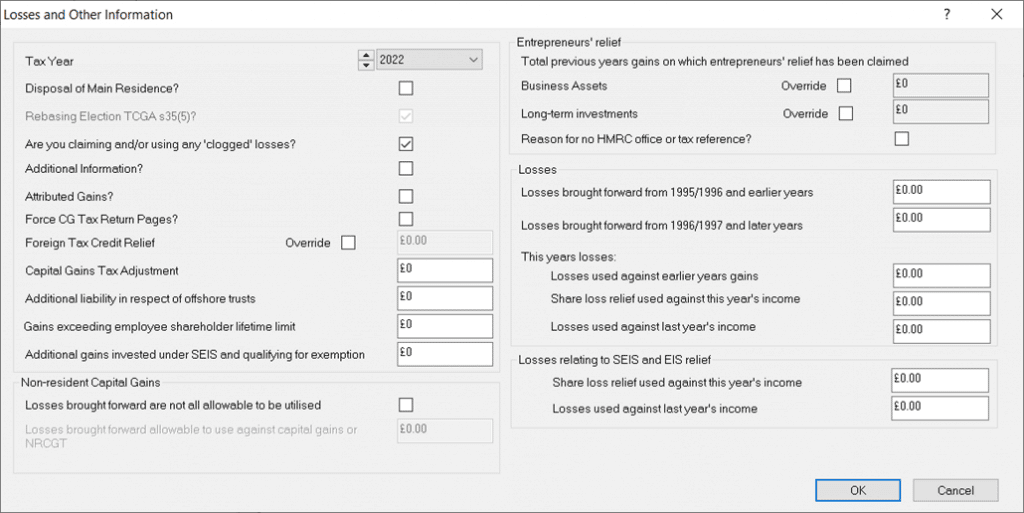

Capital assets, Edit, Losses and Other information and the Clogged loss tick box. Currently the ‘connected persons’ box is for your information purposes only – it does not affect the calculation and nor does it affect the tax return since HMRC have not catered for a connected persons box.

Therefore, you would need to delete the loss from the software to ensure it does not offset against any capital gains in the year. Look under capital assets and check for the relevant loss entry/amounts which you normally wanted to be used for clogged /connected person. Then either change the loss to 0 gain or delete the loss and add the note. You can run the Capital Gain comp as well to check for losses.

A note can be made in box 37 of page CG 2 to declare the loss amount to HMRC but however explaining why it cannot be utilised. This note is made by going into Dividends | Capital Assets | Edit | Losses and Other Information | Tick Additional Information

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.