Personal Tax- How to carry back EIS or SEIS Share loss to previous year?

Article ID

personal-tax-how-to-carry-back-eis-share-loss-to-previous-year

Article Name

Personal Tax- How to carry back EIS or SEIS Share loss to previous year?

Created Date

9th August 2021

Product

Problem

IRIS Personal Tax: How to carry back EIS or SEIS Share loss to previous year?

Resolution

NOTE: If you want a RELIEF carry back then its a different rule. If you want to claim a Share loss against the current year the read this KB

To carry back a EIS or SEIS share loss

1.Load the client and the relevant year of loss

2. Edit, Capital assets, you have to create the loss – either a Share loss or an Other Capital gain (OCG) and make a loss entry

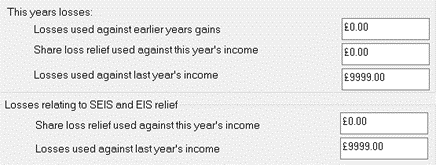

3. Edit, Capital assets, Edit(next to file), Losses and other information. You must make a DOUBLE ENTRY: In the ‘This year’s losses’ section enter the loss to carry back amount in ‘Losses used against last year’s income’ AND the loss value related to SEIS/EIS box ‘Losses used against last year’s income’. (HMRC wants to know how many losses in total to carry back and also how much of those losses are related to SEIS/EIS, so you may have a higher loss value then the SEIS/EIS claim, and vice versa the SEIS/EIS loss cannot exceed the total losses value). Example below shows that all of the £9999 losses are related to SEIS/EIS.

4. Reliefs, Miscellaneous, Tax calculation, Tax code and Overpaid, Underpaid and Repaid Tax, Enter the manually calculated tax savings value (IRIS cannot calculate this for you) into ‘Tax underpaid (-ve) / overpaid (+ve) from earlier years’

5. Reliefs, Miscellaneous, Additional information, Tax calculation SA100– add a note advising on what you have done.

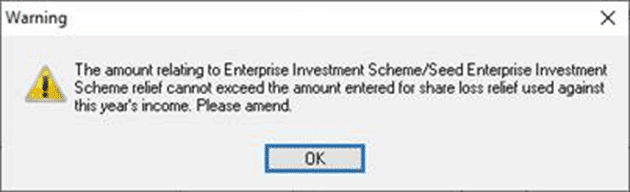

If you do not follow steps 1 to 3 then you may get this error:

If you want to show the EIS or SEIS share loss in the previous year

6.Select the relevant year where the loss is going to

7. Other Income, any other losses, “future trading or certain capital losses”, enter the EIS share loss value

8. Reliefs, Miscellaneous, tax calculation, tax code / overpaid, fill in the box ‘tax reclaiming now’ with the manually calculated tax savings value (from step 4)

9. Reliefs, Miscellaneous, Additional information, Tax calculation SA100– add a note advising on what you have done.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.