Personal Tax- Invalid Number of Full Partnership Schedules. SA104F MTR and NIC2

Article ID

personal-tax-invalid-number-of-full-partnership-schedules-sa104f-mtr

Article Name

Personal Tax- Invalid Number of Full Partnership Schedules. SA104F MTR and NIC2

Created Date

23rd January 2023

Product

Problem

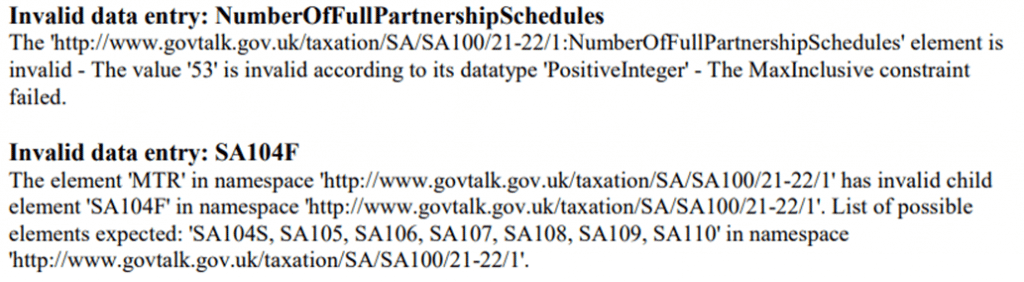

IRIS Personal Tax- Invalid Number of Full Partnership Schedules. SA104F MTR and if NIC2

Resolution

HMRC rule: You can ONLY have a maximum number of 50 Partnerships/LLPs set up. The example above has 53 FULL Partnership SA104F pages which is 3 over the maximum limit. You cannot submit online with this number of Partnerships/LLPs.

You will need to contact HMRC support on what they would recommend (It may need a paper submission).

Workaround in PT: You can save a single PDF of the Partnership returns with all the partners in completeness and then attach it to a dummy Personal tax client (with the same dates, UTR, full business values and perhaps split between 2 partners only) with a note in Additional information to explain that the PDF is the true picture of the Tax return but it cannot be filed due to the reasons mentioned above, so this dummy client can then be filed online

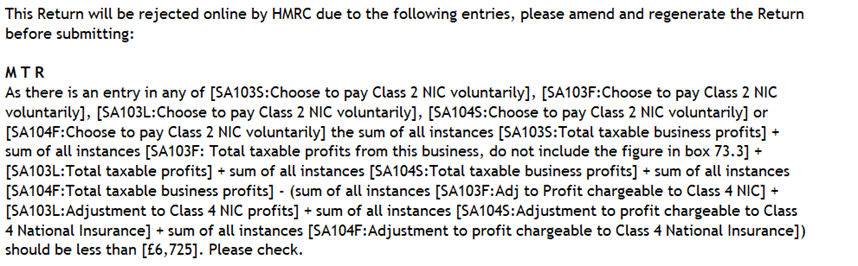

This MTR warning about NIC2 choices – please read the 6492 KB on how to fix, because if you try an submit you will get a 3001 8374 error.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.