Personal Tax- Net profit loss SA103F(S) equal sum of SA103F(S) turnover Or 3001 6055 6059 FSE 47/48/ - Expenses missing

Article ID

personal-tax-net-profit-loss-sa103f-equal-sum-of-sa103f-turnover-or-3001-6055-6059-fse-47-48-expenses-missing

Article Name

Personal Tax- Net profit loss SA103F(S) equal sum of SA103F(S) turnover Or 3001 6055 6059 FSE 47/48/ - Expenses missing

Created Date

19th May 2022

Product

Problem

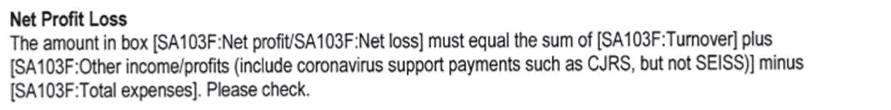

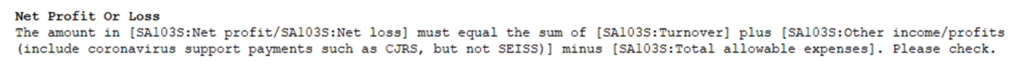

IRIS Personal Tax: Net profit loss SA103F(S) equal sum of SA103F(S) turnover Or 3001 6055 6059 FSE 47/48/ - Expenses missing for sole trader

Resolution

If you have TWO or more Sole Trade Businesses and one has claimed the trading allowance and one has claimed normal expenses. This is not permitted, as HMRC rules state: if you are claiming the trading income allowance on trade 1, this would preclude users from claiming any expenses on their second trade, or any trade. You cannot claim both the Trading Income allowance and expenses between the multiple trades. You will need to decide which you will keep either the trading allowance OR the expenses.

If you only have one sole trader business (after version 22.1.2): Open the trade business and go to Expenses Tab- click on the 1st top left cell (CIS Bought). Then use the TAB key and tab along until you reach the very bottom right cell (Other). This will refresh the Expenses Totals cell. Regenerate the tax return.

If you only have one sole trader business (on version 22.1.2): This is a known DEFECT on IRIS Version 22.1.2 (Help and About) if you have expenses for one sole trader business. The expenses will be missing from Box 20 SES1 (short pages) or on page SEF2 (Full pages). Do update to IRIS version 22.1.4.3 and 22.2.0 which fixes this issue.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.