Personal Tax: Payment on Account, How to reduce or delete a payment?

Article ID

personal-tax-payment-on-account-how-to-reduce-a-payment

Article Name

Personal Tax: Payment on Account, How to reduce or delete a payment?

Created Date

24th June 2022

Product

Problem

IRIS Personal Tax: Payment on Account, How to reduce or delete a payment? No payments if below £1000 tax due

Resolution

POAs may not appear for these 3 reasons:

1. If the tax liability is less than £1000 (Also read the very bottom of KB if your clients NIC2 is included on top of the £1000)

2. If the liability is below £3000 and is being collected through the PAYE tax code

3. If more than 80% of tax paid is met from tax paid at source

How to Reduce payment: You have one or both payments on account that are showing a value and you want to show a lower £ value instead. But when you change the value, it keeps reverting back to the original value?

1st and 2nd payments are normally auto calculated based on the balancing payments due. This is why the figures keep reverting back when you are trying to change them. Go to Administration- Claim to reduce payments- Click on a reason or enter your own to advise why the amounts are being reduced- enter the amount- click ok. The tax comp should show the new amount.

How to Delete payment: Administration – client account – find and select the relevant payment and delete. If you cannot see the entry – on the top left tick ‘Show full amounts and fully matched’.

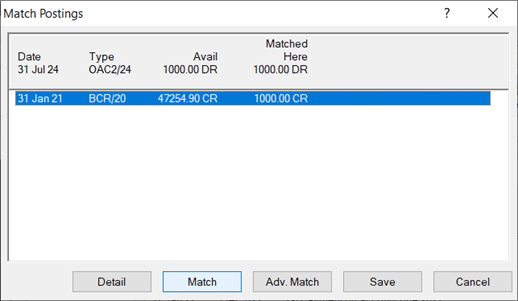

But if that doesn’t delete it, then click ‘Match‘ – a new screen will appear, then select the relevant payment (so turns blue) and click ‘Match’ again – now delete – save (this is because the payment was already matched and this cant be deleted unless you first un-match it).

How to Remove a Refund: Administration – client account – find and select the relevant value which makes up the refund and delete. If you cannot see the entry – on the top left tick ‘Show full amounts and fully matched’.

But if that doesn’t delete it, then click ‘Match‘ – a new screen will appear, then select the relevant payment and click ‘Match’ again – now delete – save (this is because the value was already matched and this cant be deleted unless you first un-match it).

How to offset a refund against a payment on account due: This is a HMRC restriction in the software you cannot offset the refund against your payments on account also there is no boxes on the return to show this therefore once the return is sent to HMRC you can ask them to offset the refund against payments on account (under Reliefs, additional info and SA100)

I have deleted the 2nd payment it returns on the Tax comp? I have removed the second payment on account entry however, when I go back to the client account post running tax comp – the second POA shows again. You will need to make a credit adjustment on the second payment on account. In the client account click on insert and enter a – credit adjustment with the amount you want to reduce the payment on account by with date and the year it is and then match that credit adjustment to the payment on account. It will show on the tax computation that the second payment on account has been reduced

Not getting Payments/NIC2 is missing from the payments on account? The Class 2 NIC does not get included in the payments on account as per HMRC’s guidelines. You may have tax due which includes the NIC2 and it brings it over £1000 then no payments of account will be calculated (eg Tax due £986 + NIC2 £179.40). Also from 6 April 2024, self-employed people with profits above £12,570 will no longer be required to pay Class 2 NICs but will continue to receive access to contributory benefits including the State Pension. This is a tax simplification that effectively abolishes Class 2 NICs by removing the requirement for self-employed people to pay.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.