Personal Tax- Bridging guide. Someone else is currently running the capital assets bridging

Article ID

personal-tax-someone-else-is-currently-running-the-capital-assets-bridging-retry-to-see-if-it-is-finished-or-cancel-to-end

Article Name

Personal Tax- Bridging guide. Someone else is currently running the capital assets bridging

Created Date

16th November 2022

Product

Problem

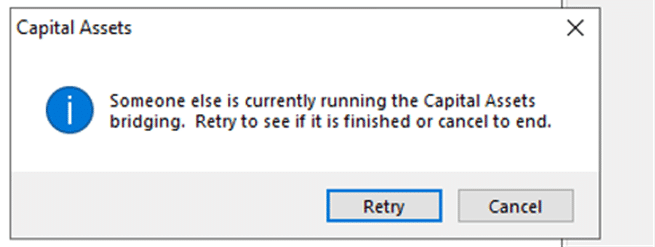

IRIS Personal Tax- Someone else is currently running the capital assets Bridging Retry to see if it is finished or cancel to end.

Resolution

This is used to bridge data that was held in Edit return, Income and Dividends to the Share Holdings section of Capital Assets. The reason for bridging is to remove duplication of data and to provide access to the optional Dividends Service. The bridging process takes “old” dividend data and either matches it to an existing share holding or creates a new share holding. At the same time it provides the option to link to a company in the “master list”. This is a list of around 4,000+ companies listed on the London Stock Exchange for which we can automatically insert cash dividends through the optional Dividend Service. Guide on how to Capital/Dividend Bridging: LINK

Someone else is currently running the capital assets bridging

For example when you click on “capital assets” below dividends and you get this warning. Please ensure that everyone is logged out of IRIS before the script is run on the server/pc. Complete the following to execute the script:

- Open SQL server | Select Databases | right click on the IRIS database generally the default name for it is “IRIS” | New Query

- Copy the following:

update [Practice].[ISOL2000]

set int_0=68

where RecordType = 9

and Userid = 0

- Paste the script in to SQL | select Execute

There are two ways to bridge the dividend data.

- Auto Bridge is quickest but available only when there are no share holdings listed on the right-hand side of the screen.

- Manual Bridging (see below)

- Select a dividend record from the left hand side of the screen (it doesn’t matter which tax year);

- Either click on the share holding on the right hand side and click Match OR click Create. IRIS will automatically highlight the most likely match. (All of the dividends for all tax years will be copied to the capital assets database.);

- After clicking Match or Create our “master list” is presented . Either <Escape> or locate the company and click OK. To use the optional Dividend service you will need to link the share holding to a company on the master list.

When all the dividends have been taken across to the right hand side of the screen, IRIS will prompt:

- Bridge Nil Value Dividends

- Bridge Holding

Check that the two tick boxes are as you require and click Yes to finish or No to abandon the process.

Finally, IRIS will offer the chance to print the bridging report which lists all the information that has been transferred. This is optional and may be printed later. To get at the report at a later date select Dividends from the Edit pull down menu (in Capital Assets).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.