Personal Tax- 'Tax Otherwise chargeable on non-excluded income'

Article ID

personal-tax-tax-otherwise-chargeable-on-non-excluded-income

Article Name

Personal Tax- 'Tax Otherwise chargeable on non-excluded income'

Created Date

12th December 2023

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- 'Tax Otherwise chargeable on non-excluded income'

Resolution

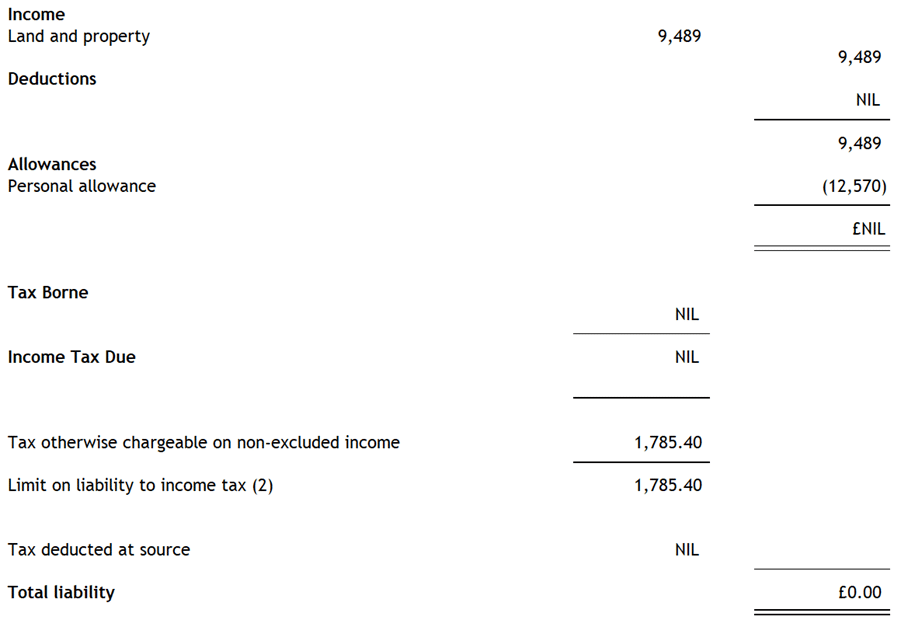

If your client is Non Resident and when you run a tax comp, you get a extra line showing ‘Tax Otherwise chargeable on non-excluded income’ and Limit on liability to income tax(2).

HMRC rules being applied when a client is ticked Non resident: The calculation could automatically use the lower value of either (1) Income Tax liability or (2) Limit on liability of oncome tax, this either creates a Tax liability OR no Tax due liability. This line cannot be removed if you have ticked Non resident.

The ‘HMRC test case generator’ (TCG) replicates this same Excluded calculation which matches the IRIS PT calculation. If you have queries on this, then you would need to contact HMRC support.

NOTE: The ‘Tax Otherwise chargeable on non-excluded income’ value is automatically calculated based on the clients income. There is no report in PT which breaks down this calculated value. If you reduce/increase income values it may change this value.

NOTE: The client has to meet a threshold to create disregarded/non disregarded income AND if Income tax (after tax reductions) is given which will trigger this extra line on the tax comp – if both are not met then this extra line will not show even if ticked ‘Non Resident’. For example: If no ‘disregarded/non disregarded income AND/OR no income tax’ is calculated then this extra line will not show (on the HMRC TCG, it will actually show up as £0 ‘disregarded income/non disregarded income’ given)

Example: Income Tax due (1) and Limit on Liability of income tax (2) , it will use the lower value which is £0 (NIL) and this will show as Total liability of £0.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.