Trust Tax: Edit capital gain 'Annual Exemption' value

Article ID

trust-tax-edit-capital-gain-annual-exemption-value

Article Name

Trust Tax: Edit capital gain 'Annual Exemption' value

Created Date

18th November 2021

Product

Problem

IRIS Trust Tax: How to edit Capital Gain Annual Exemption value

Resolution

- Load the Trust and select relevant period

- Income, Capital Gains and Dividends, Capital Assets,

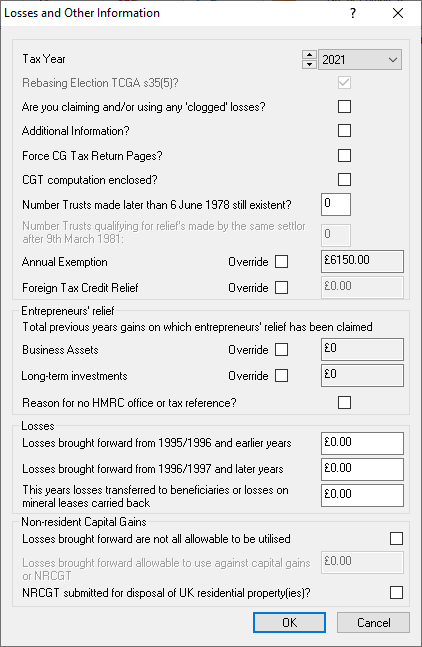

- Top left – Edit, Losses and Other info information

- ‘Annual Exemption’ box – tick override and enter the amount you want to claim

- IF this is a Discretionary Trust and there are more then 1 Trust then enter the number of trusts in the box: ‘Number of Trusts made later than 6 June 1978 still existent’ – this will auto calc the exemption amount without you overriding the value.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.