Trust Tax- How to transfer income into a clients Personal tax?

Article ID

trust-tax-how-to-transfer-income-into-a-clients-personal-tax

Article Name

Trust Tax- How to transfer income into a clients Personal tax?

Created Date

6th December 2022

Product

Problem

IRIS Trust Tax- How to transfer income into IRIS Personal tax?

Resolution

1.The Beneficiary must exist in Trust tax and also in Personal tax as a client

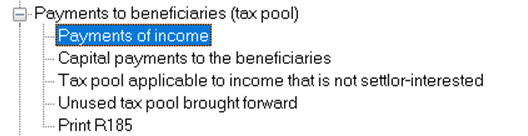

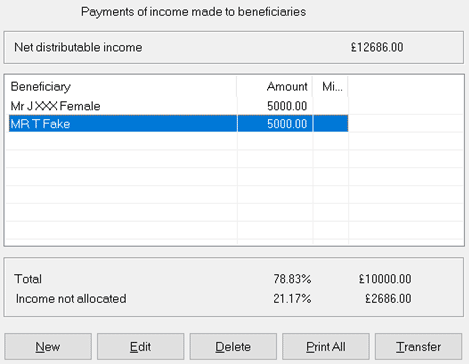

2. Complete the payment of income allocation to all the beneficiaries in Trust tax -all need their % of income allocated to them

3. On the bottom right side of the allocation screen- click TRANSFER and now load PT and the client. The income will appear under Trust, Settlements income etc.

NOTE: If you edit the trust payments while the PT client is still open, then remember to close and restart PT for it to pick the new trust payments. As it needs to refresh the data.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.