Trust Tax: R185 form Statement of income (Trust, Estates, Beneficiary)

Article ID

trust-tax-r185-form-statement-of-income-from-estates-to-beneficary

Article Name

Trust Tax: R185 form Statement of income (Trust, Estates, Beneficiary)

Created Date

19th October 2021

Product

Problem

Trust Tax: R185 form Statement of income from Trust, Estates, Beneficiary

Resolution

Note that the R185(Settlor form) can only be accessed from HMRC and not from Trust tax.

1.For a non Settlor form, load the client and select relevant tax year.

2. There are TWO paths you can use: Print Reports and Form R185 OR Other information and Payments of Income

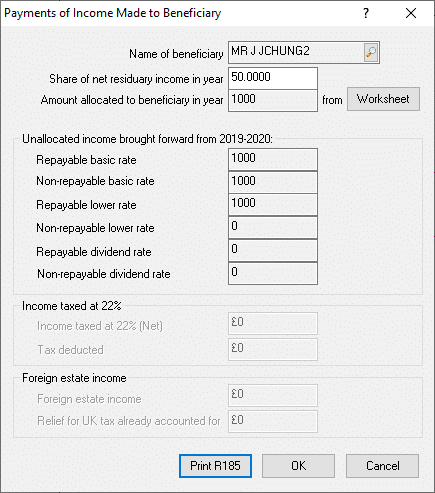

3. Make sure the beneficiary is added in and % share is allocated.

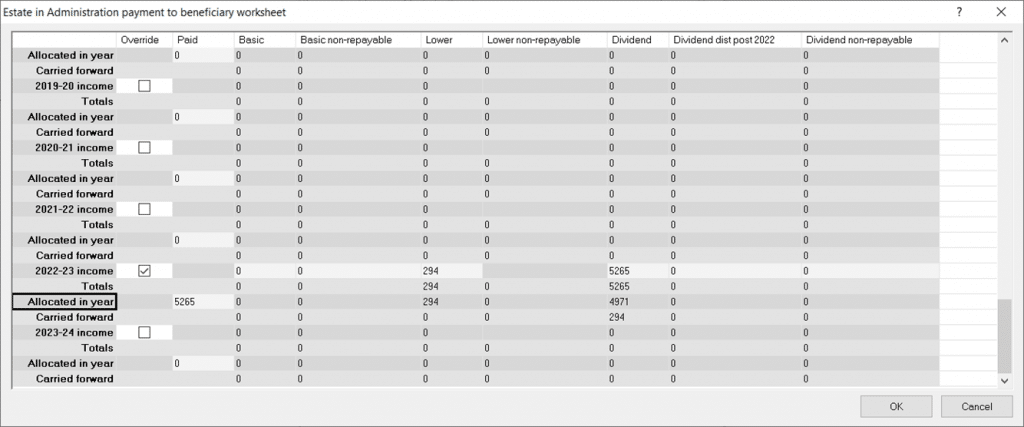

4. Click Worksheet and the find the correct income year row, and allocate the amounts to this one person under PAID column. Click OK and click Print R185.

If you want to move the income types between the columns For example 2022/20203 row, tick Override box and allocated £5265 under PAID column and then move the value from ‘Dividend non repayable’ into the ‘Dividends’ of £5265 and now shows under R185 box 18.

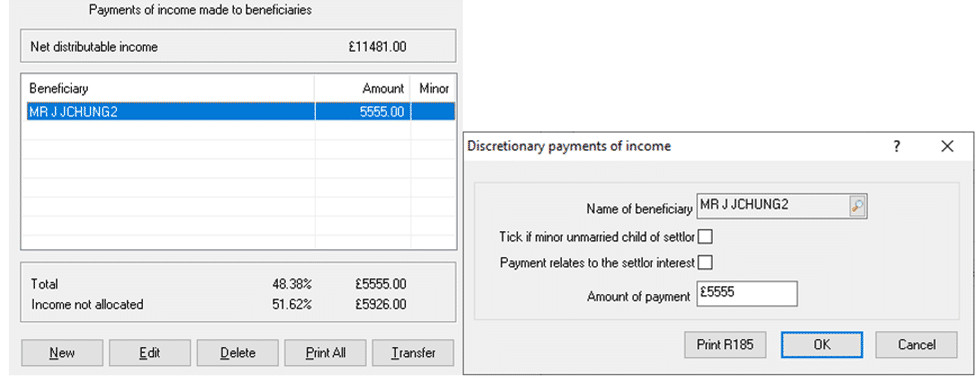

NOTE: Steps 2 and 3 are dependent on what ‘Trust Type‘ your client is under. You can check by Client | View and ‘Type of Trust’. For example, Discretionary Trust types will not have any Worksheet option and only Amount of payment field. Each Trust Type may have different options.

5. The R185 form design where box numbers appear or go missing will change dependent on the Trust Type. The HMRC website has different R185 form designs.

The ‘Type of Trust’ can change the R185 options – Discretionary Trust type only has this option when you go to R185:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.