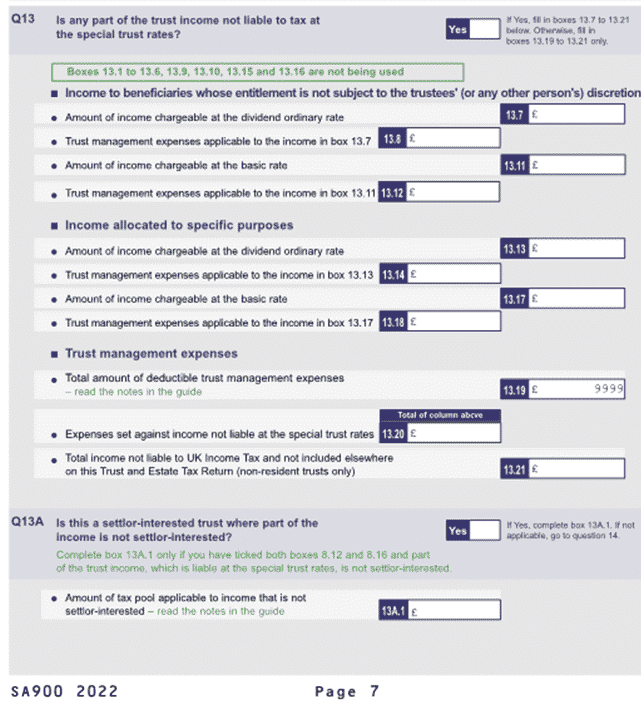

Trust Tax- Trust Management Expenses to show on Q13.19 Page 7

Article ID

trust-tax-trust-management-expenses-to-show-on-q13-19

Article Name

Trust Tax- Trust Management Expenses to show on Q13.19 Page 7

Created Date

2nd August 2022

Product

Problem

IRIS Trust Tax- Trust management expenses to show on Q13.19 on page 7

Resolution

Trust Management Expenses boxes will only be populated for Discretionary trusts and Accumulation and maintenance trusts.

Load the Trust and relevant year.

Go to Other information, Reliefs, annual payments, patent…. Trust management expenses, and put a description and the amount. This should populate Box 13.19 IF specific HMRC conditions are met on Tax rate calculations– do read the HMRC notes on the rules.

For Example this a ‘Discretionary Trust’ type below

Note: If you need to change the ‘Trust type’ to claim the expenses, then remember to go to: Other information/ Payments to beneficiaries (tax pool)/ Print R185/ highlight the beneficiary and click Edit/ Then click Worksheet and make the necessary adjustments.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.