Taking the pain out of getting paid

Updated 11th August 2023 | 4 min read Published 16th May 2022

Customers paying late or failing to pay at all is having a massive effect on small businesses.

We all know how hard it is to ask for money, even when it’s owed to us – those conversations can be difficult, especially if you need to have them repeatedly.

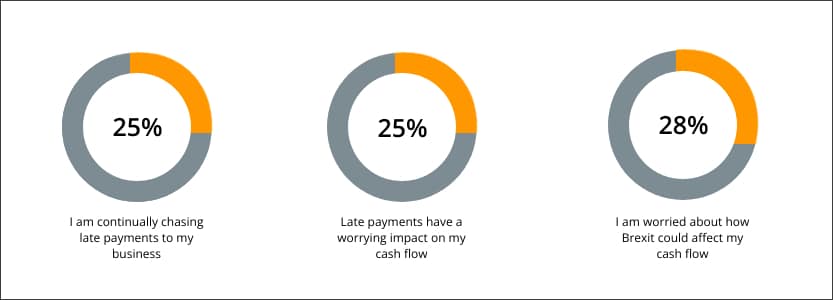

In a recent survey carried out by card payment specialist takepayments, over half of UK small businesses indicated they are either chasing payments or that late payments are impacting their cashflow.

You can read more in their annual 2022 business challenges report.

Another survey by Hitachi Capital UK indicated that over 65% of respondents experienced at least one instance where a client failed to pay within an agreed payment period.

So, what’s the impact?

Late payments can have a range of implications, including:

Impacted cashflow

Over a quarter of small businesses have experienced an impact on their cashflow due to late payments, with around 40% of business owners having to use their own funds to fill any cashflow gaps.

Reduced productivity and resource

Almost half of UK small businesses are spending anywhere between 1-4 hours every day chasing late payments, losing valuable time that would be better served growing their businesses and servicing their existing customer base.

Delays in paying your suppliers

Reduced cashflow can affect your ability to pay your suppliers, which in turn can affect your relationship with them.

Delays in ordering what you need

Getting paid late can mean delays in you being able to place orders for products or services that you need.

Unable to meet your credit demand

Paying back loans and credit cards is often harder with an impacted cashflow. Late payments can affect your credit score, too.

What can I do?

Here are six tips to improve your customer payments:

1) Make it easy for your customers to pay you

Paying online is one of the easiest ways for your customers to pay you, especially when they can choose their method of payment.

You can offer online payments with IRIS Pay. Your customers visit a secure checkout and choose how they pay you, including debit/credit card, Instant Bank Transfer (your customer confirms a payment request via their online bank account) or Apple Pay. With Instant Bank Transfers, you get paid much faster – typically within 2 hours.

2) Make sure your invoices don’t get lost

How often have you heard “I lost your invoice” or “I didn’t receive your invoice”? According to research from Satago, invoices missing or not received are the primary reasons for late payments. Make sure your invoices are sent to the right person, and don’t be afraid to follow up with a phone call to ensure it’s been received.

Producing invoices from IRIS KashFlow is quick and easy, and you can send them by email or print and post. You can also store a separate email address for payments. It’s easy to re-issue an invoice if needed. You might want to consider setting up Direct Debit payments with some of your customers – something you can also do in IRIS KashFlow.

3) Make sure invoices include the information your customers need

Include purchase orders and references and make sure your invoice is broken down into clear lines so that your customer knows what they’re paying for.

With our templates, you set up your own invoices to meet your needs, including separate invoice lines. You can also create sales quotes in IRIS KashFlow and instantly convert these into invoices saving time and ensuring accuracy.

4) Add payment links or buttons to your invoices

Including a hyperlink or pay button on an invoice makes it so easy for your customers to pay you and encourages them to pay straight away.

You can create invoices using IRIS KashFlow, which include an IRIS Pay payment link or button. The customer selects the link or button and is taken straight to the secure checkout where they can pay using whatever method they choose.

5) Send payment reminders

Don’t be afraid to send reminders when it’s time for your customers to pay or when their payment is overdue.

With IRIS KashFlow, you can send email reminders (or produce reminder letters) to advise customers when their payment is due or overdue. You can edit the reminder text based on how overdue the invoice is – we even provide some templates for you to use. You can also use our automated credit control feature that issues reminders at certain payment stages. You don’t need to think about credit control – we do the work for you.

6) Negotiate for shorter payment terms

Your payment terms need to match your cashflow needs, so don’t be afraid to negotiate them. Make sure that agreed terms are on your invoices. You might want to consider a discount for early settlements or a penalty for late payments.

You can set global payment terms in IRIS KashFlow and individual terms for specific customers. These are automatically added to invoices for you.

We hope these tips will help you get paid promptly.

There’s never been a better time to switch to IRIS KashFlow

Find out how IRIS KashFlow and our newest payment processing service, IRIS Pay, can help make a difference. Try it for free or find out more about IRIS Pay.