Generate more revenue the easy way

Updated 7th March 2018 | 4 min read Published 7th March 2018

Generate more revenue the easy way

It’s often said the easiest way to increase your revenues is to sell more services to your existing clients. Most businesses identify cross-selling as an area for business development, however few seem to achieve it.

Would you like fries with that?

Cross-selling is all about timing and relevance, it’s not about manipulating customers. The most effective way to sell more to someone is when they have a genuine interest. The classic example of this is McDonald’s when their staff ask ”would you like fries with that?”. With that single enquiry McDonalds is able to sell over 4 million kilograms of fries globally every day.

They don’t stop there, McDonalds’ employees will ask every customer if they would like a drink or to supersize their meal. The incremental revenues from these small cross-selling questions have a phenomenal impact of the company’s bottom line. Just imagine 69 million customers every day being asked to buy more.

Taking a fast food approach to your clients may not be appropriate however cross-selling is an established sales technique and one that professional services companies can adopt.

Many practices assume their clients understand all the services available. Most clients only know what information you give them, simply telling your clients about other services can bring in more business on its own.

Where to start?

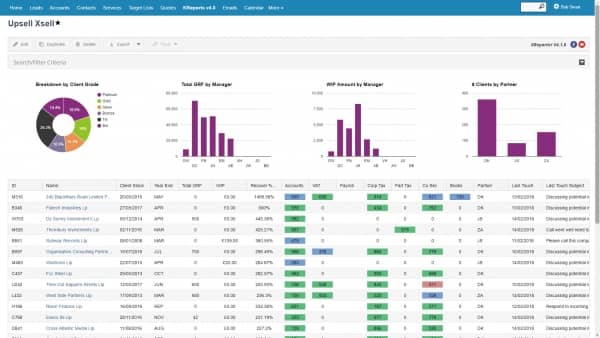

Understanding which clients take what particular service is essential and this can be achieved using the Client Engagement Matrix, one of many reports that can be produced within IRIS CRM. This powerful and informative visual interface helps identify the white space and gaps in the services clients take from a business.

From the report it’s possible to identify the total Gross Recurring Fee (GRF) per client. The report is also capable of filtering across client grades if selected.

With this valuable insight readily available it’s possible to deliver personalised, targeted email campaigns to clients with pin point accuracy, creating new sales opportunities and informing clients of valuable services they are missing.

Another benefit of the Client Engagement Matrix data is the high and low performing fee analysis. The report highlights average service line values which can be compared against other firms or across industry sectors.

The Client Engagement Matrix helps business leaders to make more informed decisions, target the ‘underperforming’ clients and service lines allowing for speedy resolution. It can:

• Analyse data across all elements of your business

• Trigger campaigns directly from reports

• Identify gaps and weak points in your business and service

• Plan for the future and respond to changing events, fast!

• Provide instant data reporting… No time-consuming data-mining involved

IRIS CRM allows business leaders to collate meaningful information, make better informed decisions and take steps to successfully develop their business.

So the next time you are tucking into a burger and fries just think about the services you are providing and the cross-selling opportunities you may be missing.