Full Retrospective or Cumulative Catch-up? – How to decide which IFRS 16 Transition Method your organisations should use

Updated 26th May 2021 | 7 min read Published 3rd November 2016

There are several questions a company will need to ask themselves when preparing to implement the new international lease accounting standard IFRS 16. One of the most important of these is what transition method will they apply for the first year of reporting.

Traditionally, when a new international financial accounting standard comes into effect, companies would be required to report using IAS 8. However, with much concern surrounding the IFRS 16 costs of implementation, The IASB have provided lease accounting guidance for a modified retrospective approach that does not require comparative reports or parallel accounting standards.

For some, the choice is obvious, but regardless, companies will need to assess whether the cost reliefs provided by the cumulative catch-up retrospective method outweigh the loss of comparability and detail in financial reports that the full retrospective method offers.

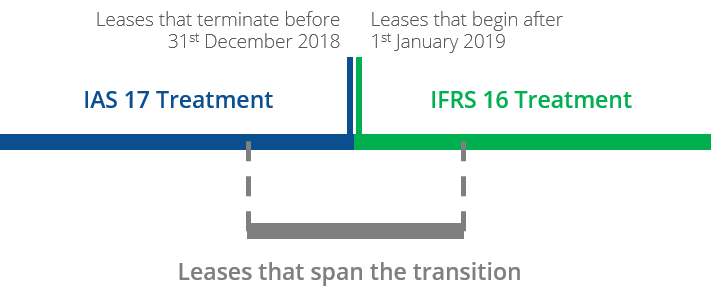

Implementing IFRS 16 will require organisations to consider their leases in three different categories:

- Leases that reach their termination date before the chosen IFRS 16 effective date (these will continue to use IAS 17)

- Leases that begin after the chosen IFRS 16 effective date (these will use IFRS 16 from the start)

- Leases that have already begun and will continue beyond the implementation date of IFRS 16 (these will require a special retrospective reporting method that explains the jump from IAS 17 to IFRS 16)

The two options provided for the transition accounting reports each have their own advantages and compromises and any decision will need to include consideration towards your company’s internal and external pressures, such as disclosure requirements or financial statement consistency.

In order to determine which method is best for your organisation, lessees are advised to model how each method would impact some of their higher risk leases. Selecting leases with irregular rates and represent a large material value for both equipment and property will enable companies to simulate the difference in applying each method as these assets are likely to have the biggest impact when it comes to applying the standard.

As this will require historic lease data that is unlikely to be readily available and involve various complex calculations, it is important not to underestimate the resources required for this initial assessment.

Full Retrospective

As the default method for IFRS accounting when a new IFRS standard has been implemented, the full retrospective method asks lessees to use IAS 8 when accounting for leases in the first year of transition. This requires the organisation to report on their leases as if IFRS 16 had always been in effect, requiring historic lease data.

This method also requires lessees to report on two IFRS accounting standards simultaneously to show the difference between IAS 17 and IFRS 16 and the effects of the new lease accounting standard on financial statement reporting.

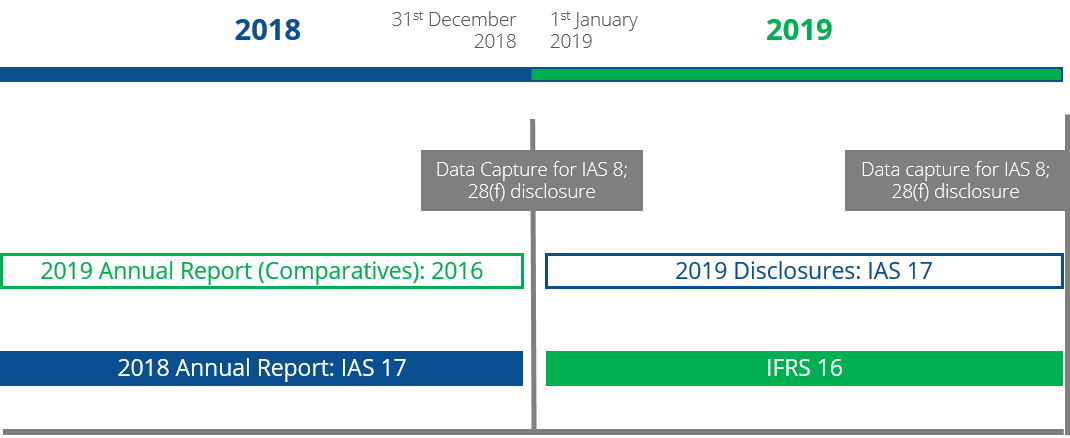

The above example depicts the lease accounting report requirements for a lessee with an implementation date of IFRS 16 as the 1st January, with a December year end.

The lessee will apply IAS 17 in the 2018 annual report – i.e. without operating leases appearing on balance sheet and a P&L with a straight-line rent expense.

The 2019 annual report will apply IFRS 16, recognising operating leases on balance sheet, separating interest and depreciation. This report will also include comparative figures.

Similarly, IAS 8 requires the lease accounting disclosures to include a line by line comparison of IAS 17 vs. IFRS 16. The 2019 disclosures will require data capture at each end of the implementation year and therefore requires an organisation to apply IAS 17 to their disclosures alongside IFRS 16 in the first implementation year.

Pros

- A more detailed overview of the figures and how they’ve changed under IFRS 16

- Better quality of reported information captured for the first year audit

- Does not require estimates so less chance of misrepresentation of financial figures

- A comparable and transparent set of data for financial users; more in line with IFRS 16’s aims

Cons

- Will need to report comparative figures, which requires a great deal of historic lease data

- Effectively needs to produce two annual reports (one for IAS 17 and one for IFRS 16)

- Likely to be more expensive and use more resources

- Requires more reports and disclosures.

Cumulative catch-up

Based on feedback regarding the complexity and costs of collecting historical lease data and reporting both IAS 17 and IFRS 16 parallel to one another, the IASB have allowed lessees to use a modified retrospective method for reporting IFRS 16 in the first year of implementation

This method does not ask for comparative figures and uses the net effect of applying IFRS 16 on the first day of the first accounting period in which the new standard is applied. The net effect is recognised through an adjustment of retained earnings or other relevant parts of shareholder’s equity.

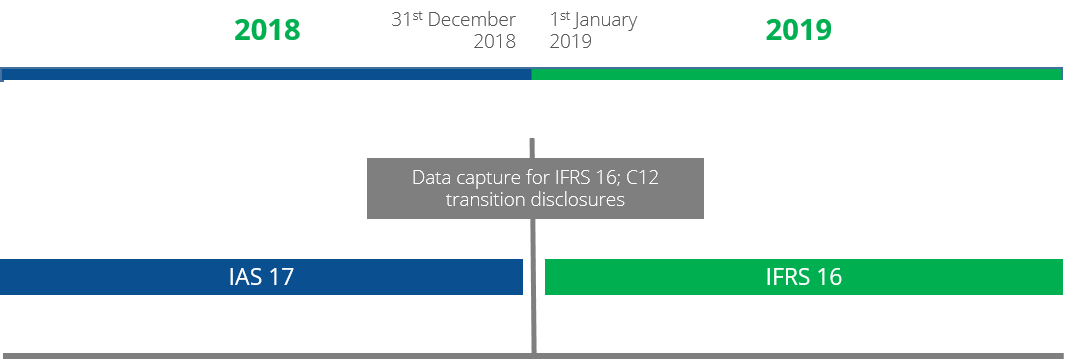

For a company with the same year end and implementation date as the example above, the transition method appears less convoluted; although this does come at a cost.

The lease accounting illustrative example above shows an almost direct switch from IAS 17 in 2018 to IFRS 16 for 2019 financial reports onwards; there is no dual accounting at any point.

There is still a data capture required for the lease accounting transition disclosures. A lessee will need to provide comparisons, discounting the disclosed operating lease commitments and the amount of lease liabilities capitalised following implementation. This sacrifices the accuracy of the full retrospective method and in some cases, will result in higher estimates and limit of the comparability of the company’s annual financial statements.

The cumulative catch-up retrospective method does allow for further lease accounting reliefs for the first year of IFRS 16 application, which are not available under the full retrospective approach. This includes accounting relief for lease liability measurement, ROU asset measurement and a further exemption for leases ending within the first 12 months of implementation.

Pros

- Reduce the scope of reports

- Significant cost reliefs and likely to require fewer resources

- No need for parallel accounting reports

- No need to produce comparatives

- Allows for additional reliefs available for the first year of transition

Cons

- Less accurate figures may result in over-estimations

- Compromise in year on year comparability for the first year of application

- Incremental Borrowing Rate (IBR) may not be as favourable as rates you’ve agreed at inception

- This can skew financial metrics in a negative fashion

At a base level, the cumulative catch-up method of lease accounting appears to be simpler in practical terms as it does not require two methods of accounting for leases at one time or the need to republish financial reports. Companies are advised to run early impact assessments for the assets they anticipate seeing the biggest effect from the IFRS 16 transition method decision.

The impact of accounting for leases using IFRS 16 needs to be assessed in the early stages of preparation to allow an organisation to identify shifts in their financial statements and develop the appropriate actions needed to lessen the burden of switching from IAS 17 to IFRS 16.

The fastest and most efficient way to compare and assess you businesses leases is through lease accounting software. Spreadsheet accounting is limited and unsuitable for IFRS 16 lease accounting; especially when it comes to the initial assessment and scenario modelling stages of preparation. Innervision’s lease accounting software, LOIS allows companies to simulate how their leases will be impacted by either transition method. By running dual scenarios, companies will be able to determine whether it would be more beneficial for their business to employ the Full Retrospective or the Cumulative catch-up method.

This is one of many initial impact assessment reports LOIS offers to enable businesses to see exactly how their financial statements may be impacted, allowing them to develop a considered and cost-effective strategy in advance.

To find out more on lease accounting changes and IFRS 16 implementation and preparation, download one of our many useful and practical guides or follow this link to talk to one of our leasing experts about your company’s preparation plans.

For more information on the impact of the lease accounting standards and how to formulate a cost effective implementation strategy, follow this link to to access a comprehensive guide to transitioning to either IFRS 16 or FASB ASC 842.