The Importance of an Early Lease Accounting Impact Report: IFRS 16 Example

Updated 26th May 2021 | 6 min read Published 4th August 2016

IFRS 16 and FASB ASC 842 are set to revolutionise the way companies account for their leases, which will have a knock on effect on their balance sheets, income statements, as well as impacting important financial metrics. As virtually every company that leases will be impacted, it is vital that lessees conduct an assessment of the new standards’ impact on their financial statements and operational performance as early as possible.

Very few will be surprised that the majority of businesses have yet to prepare for the implementation of the new lease accounting standards. Even those that have begun to budget, collect lease data or even start researching IFRS 16 and FASB ASC 842 are still in the early stages. However, with relationships with suppliers, banks, shareholders and investors all affected by the new standards, companies should not put off their initial assessments for too long.

What’s happening?

The new lease accounting standards replace the current separation of on balance sheet and off balance sheet lease accounting. $2.8 trillion worth of lease commitments, mainly arising from operating leases, will be brought onto balance sheet. The arising assets and liabilities previously unrecognised within the balance sheet will have a knock-on effect on many financial metrics, which will in turn affect a company’s relationships.

Although it has been noted that this accounting information has been available with the footnotes of the balance sheet and many investors already take this into account, the new standard aims to provide greater transparency for the users of fiscal statements and will no doubt still change the way some companies are viewed financially.

Keep up with the latest lease accounting news with our IFRS 16 and FASB ASC 842 updates

What should be done?

The best way an entity can prepare for this change is firstly to know exactly what impact the new lease accounting standard is going to have. They should conduct an early lease accounting impact assessment, using the known lease data they have to calculate and predict how their financial metrics will alter.

Using real-time data gathered from their active lease portfolio, a lessee can get the most up-to-date, relevant and accurate impression of the impacts. This valuable information can then be used to guide their implementation to ensure the transition to IFRS 16 or FASB ASC 842 is as undisruptive and efficient as possible and also triggers the needed conversations with bankers, auditors, shareholders etc.

As a manual operation, this process will be long-winded, complex and likely give way to inaccuracies. Lease Accounting experts from KPMG, Grant Thornton, PwC etc. have all highlighted that businesses will struggle to comply to the new lease accounting standards if they use spreadsheet based accounting as this platform is inadequate for the transition.

Why the delay?

It may seem unreasonable that numerous business have yet to begin this critical process for lease accounting implementation, but there are valid reasons as to why businesses have been slower to start their initial assessment.

The delay problem stems from the previous lack of urgency regarding the new standards. The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) have taken their time to ensure that lease accounting standards are as reasonable, effective and consistent as possible, totting up over a decade of meetings and 2 exposure drafts. As such, many finance leaders following the standards’ development have understandably moved onto more pressing issues, such as the implementation of IFRS 15 Revenue from Contracts with Customers.

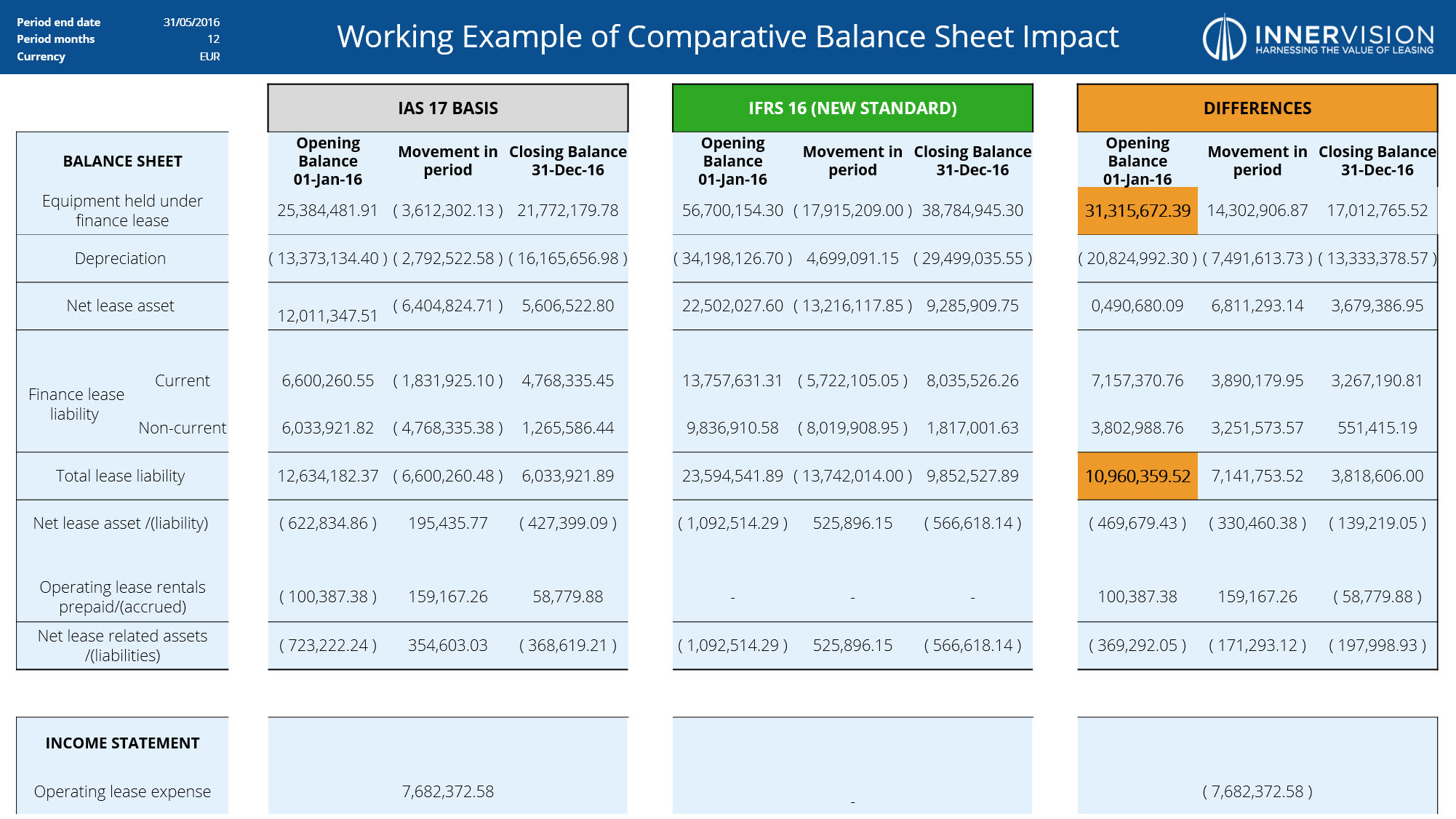

Another, is that too many lessees do not have adequate software or a complete centralised database of their lease portfolio. An impact assessment of how the balance sheet differs under IAS 17 and IFRS 16 (FAS 13/Topic 840 and ASC 842 for FASB users) is most useful when all the lease information is assessed. If there are data gaps, the information is not accurate and less credible when planning for implementation.

This lack of centralisation and complete data is most likely due to a shortfall in lease management optimisation. Leasing has always been vital to businesses, but few have invested in ensuring that all their lease documentation and associated information is readily accessible and efficiently stored. Organisations that have invested in lease management solutions are already one step ahead of many companies when it comes to lease accounting implementation as their data is up to date and easy to source.

Lease accounting impact report and portfolio health check

Once a company’s leases are centralised in one place and they have a fully comprehensive account of all lease data, then they can calculate the IFRS 16 accounting impact their financial metrics.

The most common effect will be a rise in a business’s recorded debt and a substantial increase in assets and liabilities on balance sheet, as well as impacting, reported profit performance, financial ratios, performance measures and other financial metrics. IASB estimates that bringing leases onto the balance sheet will increase earnings before interest, taxes, depreciation and amortisation (EBITDA) all by 10%.

With accurate and relevant data, an entity can then be proactive in their implementation preparation efforts. Conversations with stakeholders, renegotiations with lessors and wider analysis into their leasing activity, a lessee is able to refer to reliable figures about their own business, keeping them in full control of their leasing, financials and compliance.

A secondary, but highly useful benefit of this centralisation process is that companies now have a useful insight into their entire lease portfolio. Through the analysis of the results and the actual gathering process itself, the requirement to collate lease data highlights inefficiencies and areas for improvement within a company’s leasing processes.

- If lease data was wide spread and documentation difficult to source, then the organisation knows the process needs tweaking

- If there are leases that have unfavourable rates and terms, then the company can refocus their lease negotiation tactics

- If there are leases that have extended their initial term unknowingly or assets still being leased at the primary rate, then the business can improve its end of lease management procedures

This heightened visibility provided by a comprehensive and complete database of centralised lease agreements provides much greater control and efficiency within a business’s leasing activity. This is particularly useful for companies that have not previously invested time into their lease management as the advantages provided will allow them to continue to save on their leasing agreements, providing a much-desired, long-term return on investment from their preparations for lease accounting adoption.

LOIS Readiness Assessment and Impact Report: IFRS 16 Example

This information provides LOIS users a clearer indication of the impact the transition will have on financial statements, allowing them to plan the best response and begin discussions early and alter their current leasing activities as required to accommodate the challenges arising from the IFRS 16 assessment.

For more information about how lease accounting is set to effect businesses or how Innervision and LOIS are helping companies achieve full compliance alongside savings, get in touch with one of our leasing experts.