BLOGS

Free bite-sized training: Pay Reference Periods

Pay Reference Periods are concerned with when people get paid and are dependent on the types of hours that people work. The PRPs are defined by the date an employee is paid, NOT the period worked. This is important as it can cause confusion for employees who are being paid in arrears.

Things can get a little trickier when you have employees that get paid on a weekly basis.

And all of this affects auto enrolment. Some may not think that Pay Reference Periods are that important to auto enrolment, but the reality is that if you get them wrong, it could cause problems with your pension provider output file.

In the free bite-sized training on Pay Reference Periods, you will learn:

- What are Pay Reference Periods

- How to set Pay Reference Periods up within your software

- How they affect auto enrolment

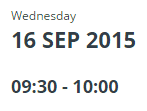

Click below to book your free place on the quick 20-minute, online training.