What to do when an employee dies - FPS

Article ID

11052

Article Name

What to do when an employee dies - FPS

Created Date

6th April 2017

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How do you mark an employee as deceased on an FPS?

Resolution

HMRC have not included a “date of death” field or “deceased indicator” on the FPS. You should make the deceased employee a leaver and make the leaving date the employee’s date of death.

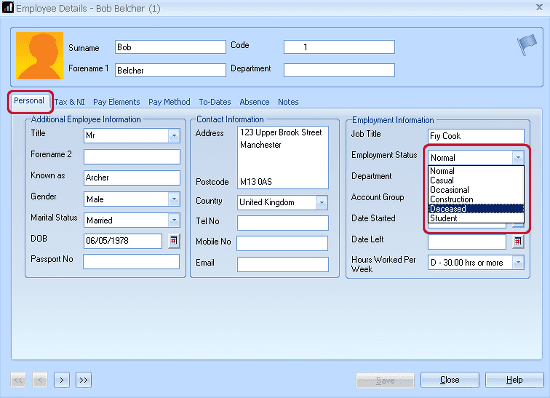

Double-click on the employee name to open their details. On the first tab of details set their employment status to “Deceased”:

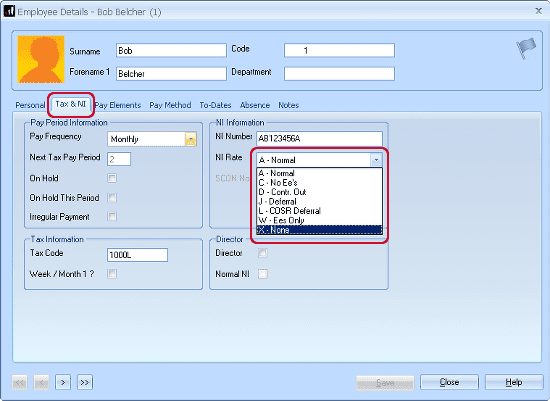

If there is outstanding pay to be processed for this employee is should be run on the NI rate X.

Go to the “Tax & NI” tab and set the “NI Rate” to “X-None”:

“Save” and “Close” the record. Make any final payments due to the employee as normal.

Finally, set the employee as leaver as you would with any leaver. Go to “Employee” > “P45 Leaver”. Remember, the date of leaving used should be the employee’s date of death.

Guidance from gov.uk website:

“You must make all outstanding payments when an employee dies. Put the date they died into the ‘Date of leaving’ field in your next Full Payment Submission (FPS), and deduct tax using their existing tax code. Don’t deduct and pay National Insurance or produce a P45.“

Full link here:-

https://www.gov.uk/what-to-do-when-an-employee-dies/paying-employee-died

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.