How to produce a P45 under RTI

Article ID

11123

Article Name

How to produce a P45 under RTI

Created Date

1st April 2019

Product

IRIS PAYE-Master

Problem

I have a leaver, how can I prepare a a p45 and report this to HMRC?

Resolution

In terms of the payroll cycle the process would be:

• Enter Variations

• Calculate Payroll

• Produce reports (Summaries, Payslips, Pensions, etc.)

• Create BACS payments file (if applicable)

• Mark employees as leavers (and produce P45’s)

• Send Full Payment Submission (FPS)

• Finalise period

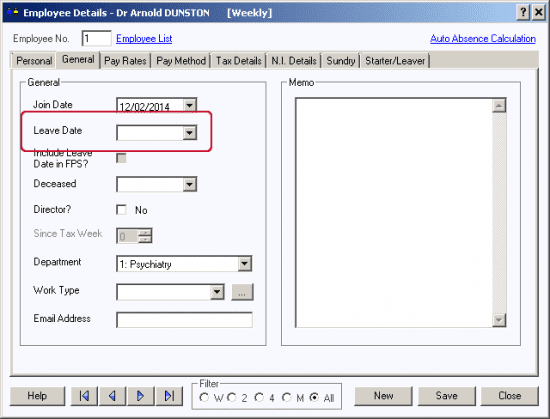

When marking someone as a leaver, first you record their leave date in the employee details. This is found in the “General” tab of the employee details:

Type the leave date in and “Save“. Because you have had to save a change to employee details AFTER you have calculated the period you will now need to refresh the calculation. Click on calculate.

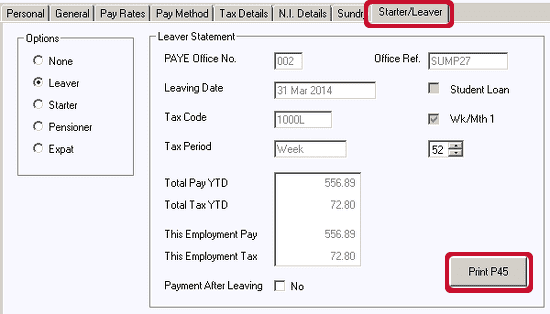

Once this is complete, go back in to the employee details and print the p45 from the starter/leaver tab:

The printed p45 is to give to the leaver to take to their new place of work.

When you send the FPS for this period to HMRC it will include all the information they require to action this employee as a leaver from this company payroll.

Printing a p45 for a previous pay period.

If you have saved the leave date for an employee and finalised the pay period without printing the p45, you can still go into the leavers details > “Starter/Leaver” tab and print the p45 using the step as above.

The software will prompt you to calculate the period you are currently in but this will not affect the pay details for the leaver, the p45 will produce with the correct values.

If you didn’t save the leave date before you finalised the period you can either:

• Recover a backup / the pre finalised data for the pay period, mark the employee as a leaver and resend their FPS information. Depending on the pay date, this could well be a late submission, you would need to complete a reason for late submission.

• Mark the employee as a leaver in the current pay period (using the actual leaving date). Make sure they are placed on hold for the pay period so they do not get an additional payment. Process the rest of your payroll and send the FPS as normal. In this situation, the employee would be sent as an unpaid leaver in the pay period.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.