Setting up Statuatory Maternity Pay (SMP)

Article ID

11171

Article Name

Setting up Statuatory Maternity Pay (SMP)

Created Date

1st May 2019

Product

IRIS GP Payroll

Problem

How do I set up SMP on the system?

Resolution

1st time set up

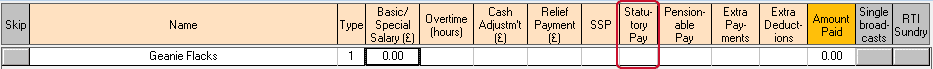

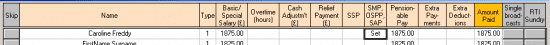

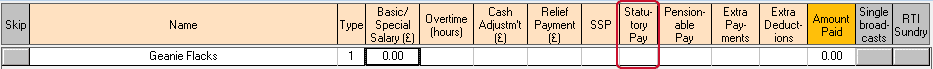

Go into “Payroll Calculations“. On the list of employees; double click into the “Statutory Pay” column against the employee you want to pay SMP.

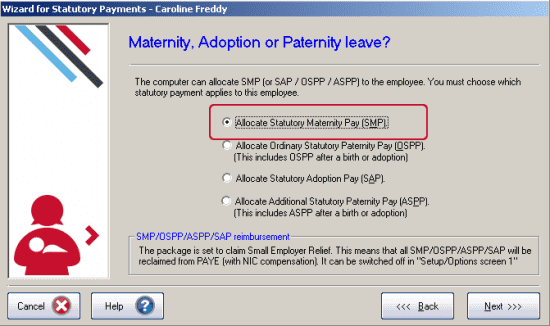

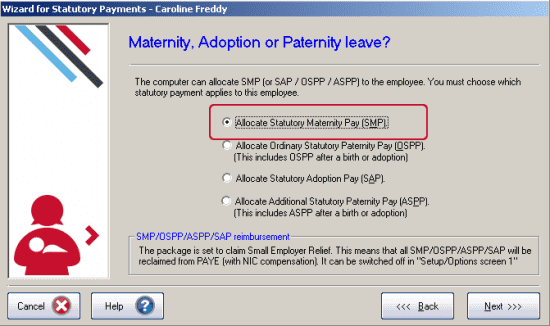

Choose the option “Allocate Statutory Maternity Pay” and click “Next“

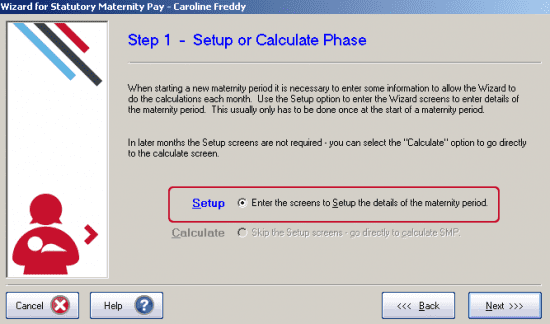

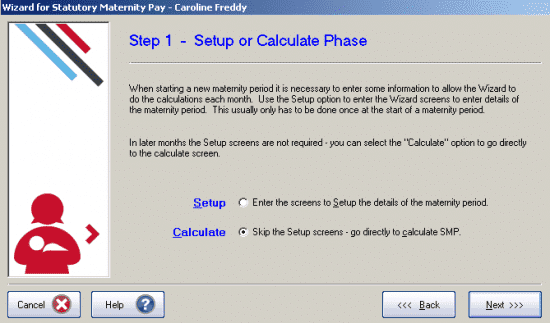

Step 1 – Setup or Calculate Phase

Choose “Setup” and click “Next“

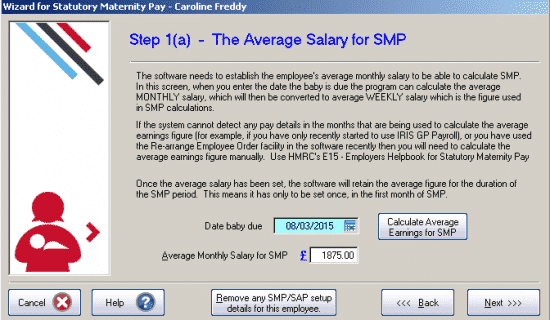

Step 1(a) – Average Salary for SMP

On this screen, you need to calculate and enter the average monthly salary for the employee during the qualifying period.

If there is enough pay history on the system you can click “Calculate Average Earnings for SMP” to auto fill the average monthly salary value. Otherwise, you will need to calculate what the average monthly salary should be.

The Qualifying Period

The qualifying period is an 8 week period starting 23 weeks before the baby due (from MATB1 form), ending 15 weeks before the baby due date.

You need to equate any payments made to the employee within this 8 weeks period to a monthly average and type this value in the “Average Monthly Salary for SMP” field.

If you need assistance calculating the average monthly salary please contact the HMRC.

Once you have completed the due date and the average salary click “Next“

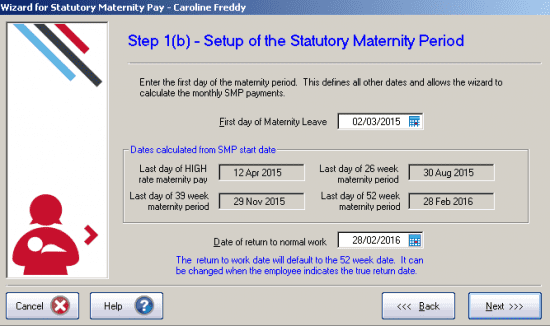

Step 1(b) – Setup of the Statutory Maternity Period

On this screen you need to record the first day of SMP, ie the first day the employee is going to absent from work and the date to return to normal work.

The system will complete the Date of return to work automatically. This will be set to the default 52 weeks leave period. Remember the employee is entitled to take leave up to 52 weeks but SMP only covers 39 weeks of pay.

Click “Next”

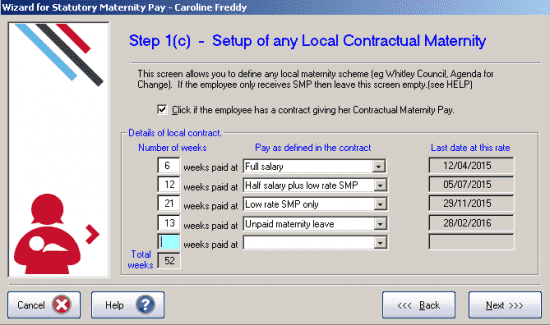

Step 1(c) – Setup of any local Contractual Maternity

PLEASE NOTE: The details shown above are for demonstration purposes only. Under no circumstances should you assume these are the correct periods of contractual SMP for your purposes. If you are in any doubt about the contractual SMP for your employees please contact the PCT.

This screen allows you to enter the details of any local maternity scheme. IRIS GP Payroll can then carry out the salary calculations automatically each month. If the employee has a contract which pays more than the standard SMP scheme then you should click on the check box to open the screen to accept the contractual scheme details.

The scheme must be defined for 52 weeks – even if the employee has no intention of taking 52 weeks leave. This will probably involve adding a number of weeks at the end as unpaid maternity.

Although the local scheme may only pay a “special” maternity rate for 26 weeks the low rate maternity payment should be entered up to the 39th week as all women now qualify for low rate maternity until 39 weeks.

Click “Next“

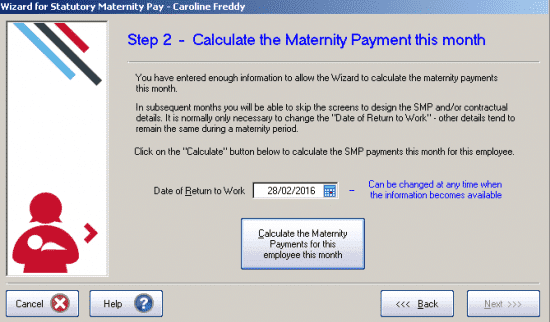

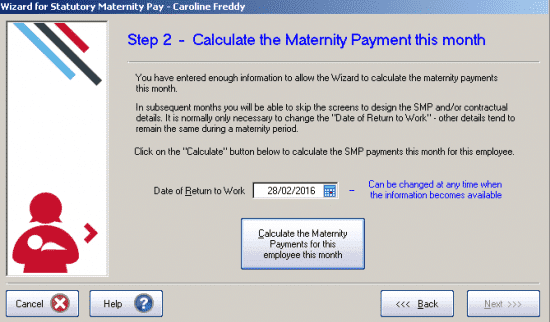

Step 2 – Calculate the Maternity Payment this month.

Click the “Calculate the Maternity Payments for this employee this month” button.

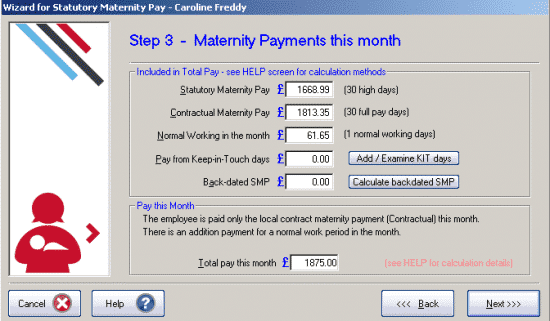

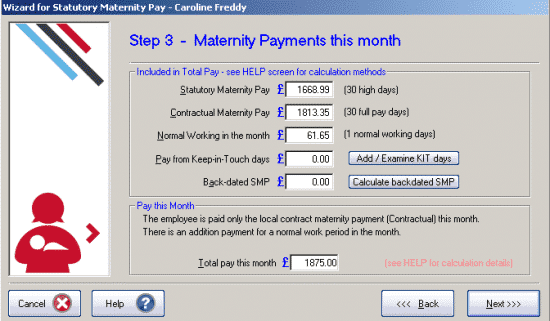

Step 3 – Maternity Payments this month

The system will show a breakdown of the calculated maternity pay, including any contractual maternity pay if configured previously.

Click “Next” (NOTE: The button will be labelled as “Finish” if the employee is NOT part of the NHS pension scheme). You are returned to the first screen, SMP column for the employee shows a “Set” and the basic/special salary and pensionable pay values will be adjusted as necessary.

Additional Step 4 – NHS Pension and Maternity Pay

The rules of the NHS pension scheme require that the employee pays contributions on the actual amount paid in the month while the employer continues to pay contributions on the normal full salary.

The SMP wizard has spotted that this employee is being paid less than full salary and is, therefore, arranging that the employee pensionable pay is the actual pay in the month while the employer pensionable pay is set to full salary.

It is possible to change the pensionable pay amounts on this screen but this should only be done in very special circumstances – IRIS GP Payroll has set the correct pensionable pay amounts for most circumstances.

If you are unsure about these values please contact the pension agency.

Click “Finish” and you’re done.

Paying SMP next period

When you come to run the next pay period, to allocate the next block of SMP, go into “Payroll Calculations“. On the list of employees; double click into the “Statutory Pay” column against the employee you want to pay SMP.

Choose the option “Allocate Statutory Maternity Pay” and click “Next“

Step 1 Setup or Calculate

Select “Calculate” and click “Next“

Step 2 Calculate the Maternity Payment this Month

Edit the “Date returned to work” if required and click ” Calculate the Maternity Payments for this employee this month “

Step 3 – Maternity Payments this month

The system will show a breakdown of the calculated maternity pay, including any contractual maternity pay if configured previously.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.