Employee not paying NI deductions

Article ID

11195

Article Name

Employee not paying NI deductions

Created Date

6th April 2017

Product

IRIS Payroll Professional

Problem

I've processed pay for an employee but there are no NI deductions being processed.

Resolution

If the employee is paid over the NI threshold and the system is not taking any NI deductions we need to check the number of periods being applied to the calculation.

Go to Payroll > Do/Redo Payroll

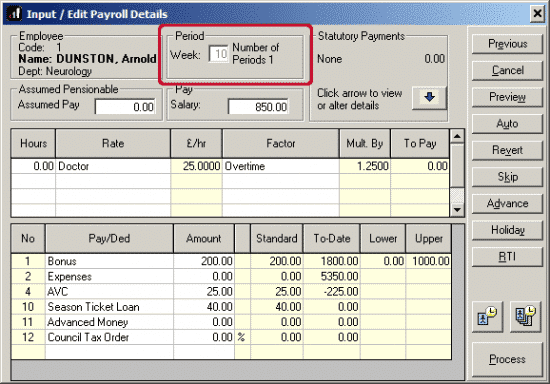

On the affected employee(s) variations check the “Period” information. Here it will show the week or month number being processed. To the right of this, it will show you the number of periods. This should always be one (unless advancing an employee holiday pay or processing an annual payroll):

The number of periods determines what thresholds are applied for the NI calculation. We often see this when a new starter has been added to the company but their “Next Tax Pay Period” hasn’t been set correctly.

To correct the record:

Cancel out of the variation screen.

If you have already saved variations, go to Payroll > Undo Payroll.

Select the affected employee and pay period and undo the processing.

Go to Employee > Select Employee.

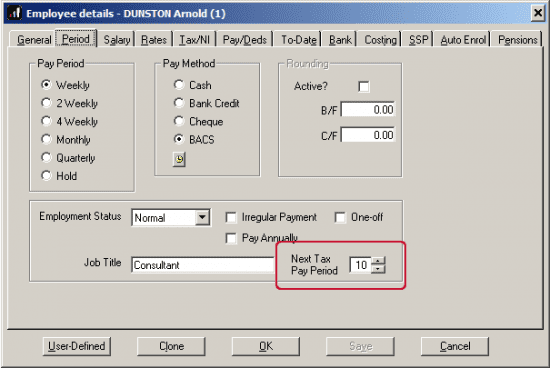

Open the details for the affected employee and go to the “Period” tab.

In the bottom right hand corner of this screen it will show you the “Next Tax Pay Period” for this employee. Change this value to match the period you are currently running:

“Save” and “OK“

Go to Payroll > Do / Redo Payroll and reprocess this employee.

You will now see the correct NI deductions processed.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.