How to process statutory sick pay (SSP)

Article ID

11228

Article Name

How to process statutory sick pay (SSP)

Created Date

13th November 2019

Product

Earnie

Problem

How do I pay SSP (Statutory Sick Pay) to an employee?

Resolution

SSP can be paid manually to any employee, if you can calculate the value of the payment you would like to make you can type this directly into the “Statutory Payments” section on the payroll run screen. You need to click the arrow button and type the value into the “SSP” field.

You can also record sickness period in the employee diary to get the system to calculate the SSP values for you.

To set up an auto absence calculation:

• Go to “Employee” > “Absence Diary”.

• Double click on the employee in question.

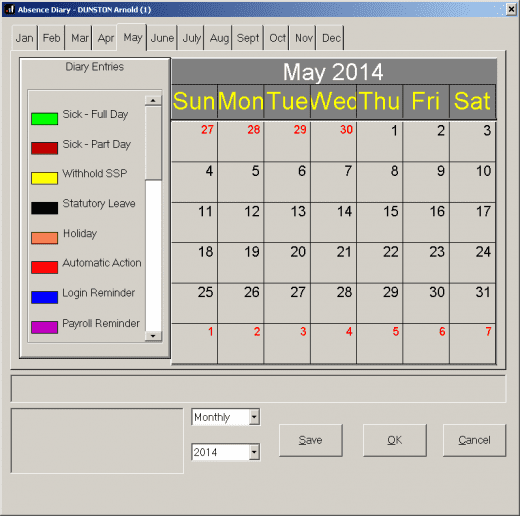

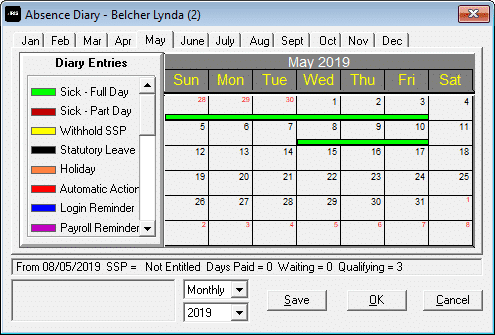

• You will be presented with the diary calendar view:

• Double click on the green box for “Sick – Full Day” down the left hand side of the window.

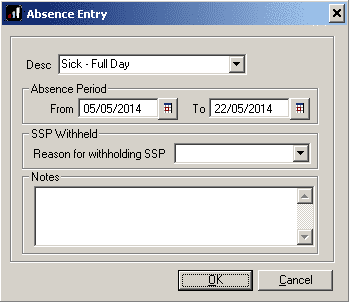

• The “Absence Entry” window will appear. Set the “From” and “To” dates you want to indicate the employee absent for:

NOTE: The system will automatically knock off the waiting days. Record the sick leave from the first day of absence NOT the first paid day of absence.

• Click “OK”.

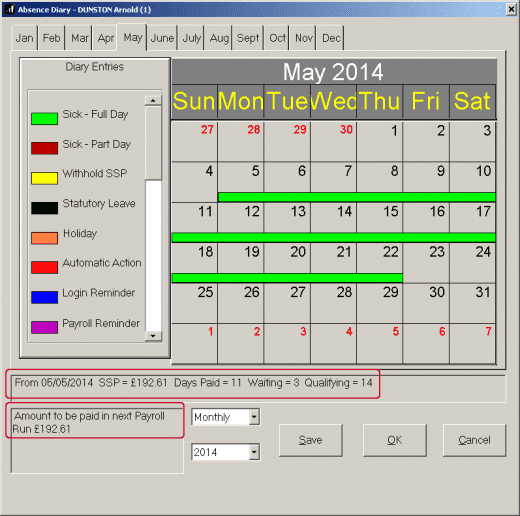

• On the calendar view you should now see a green bar running over the date you selected. If you hover the mouse pointer over this bar you will a breakdown of the qualifying, waiting and paid days in the absence period:

• Click “Save” and “OK”.

• When you go to “Payroll” > “Do / Redo Payroll” the amount of SSP paid in the period will be automatically filled in for the employee.

Your employee’s absence must form a Period of Incapacity to Work (PIW) ie. A period of sickness lasting 4 normal working days or more in a row, before SSP is paid.

PLEASE NOTE: From the 14/15 tax year you are no longer allowed to reclaim any of the cost of SSP paid to employees. As such when paying SSP there is no longer a requirement to send an EPS (employer payment summary) to HMRC.

Linked Periods of Sickness

If an employee returns to work and is subsequently off again the periods of abscence may be linked.

For a period of absence to be linked, the periods must:

- Last 4 or more days ie. still qualify as a Period of Incapacity to Work

- be 8 weeks or less apart.

If a period of incapacity to work is linked to a previous absence the three waiting days will not count, but the absence still needs to cover 4 or more consecutive normal working days.

Example of Linked Period of Absence

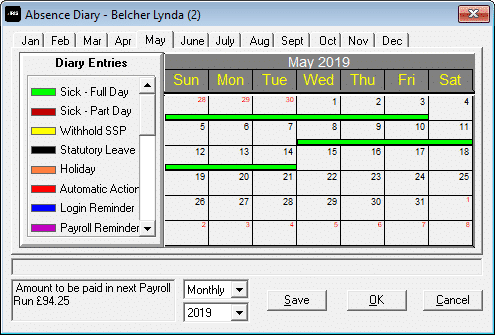

You would record any further absence in the software as described above, in the employee absence diary.

In this example the employee has been absent from work in month 1 and received SSP. In month 2 the employee returned to work for a couple of days and then went off again.

Example 1

In this example, the employee returned to work for Monday and Tuesday and then was off work again until the following Wednesday. This qualifies as a linked period and the employee will be paid SSP for 5 days absence with no waiting days applied.

Example 2

In this example, the employee returned to work for Monday and Tuesday and then was off work again until the following Monday. As this second period of absence is fewer than 4 consecutive normal working days it does not count as a period of incapacity to work and is not linked to the previous absence. As such the employee is not entitled to SSP for this second period of absence.

Phased Return To Work

If you agree a phased return to work or altered hours after a period of sickness, pay SSP for the days that your employee is sick in the normal way. Any day for which SSP is paid will count towards the maximum entitlement of 28 weeks.

Your employee’s absence must form a Period of Incapacity of Work (PIW) ie. A period of sickness lasting 4 days or more in a row, before SSP is paid. Remember, that is Statutory Sick Pay. You are not limited in what you decide to pay to the employee as salary/hourly rates.

For more details please refer to:

https://www.gov.uk/guidance/statutory-sick-pay-employee-fitness-to-work

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.