How to process Statutory Sick Pay (SSP)

Article ID

11233

Article Name

How to process Statutory Sick Pay (SSP)

Created Date

20th November 2019

Product

IRIS GP Payroll

Problem

How do I pay Statutory Sick Pay (SSP) to an employee?

Resolution

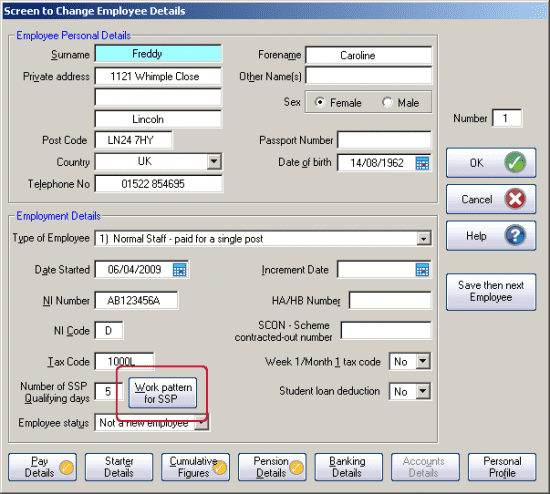

Employees Normal Working Pattern

First you may need to configure the employee normal working pattern. This may have already been done when you first created the employee record. To set the working pattern open the employee details and click on the button “Work pattern for SSP“:

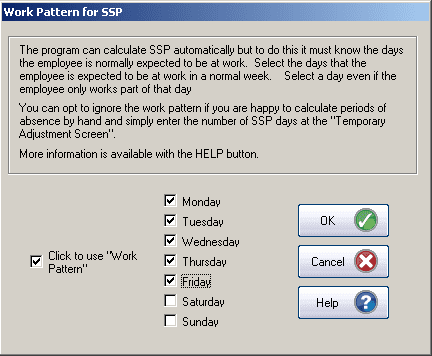

Tick the option “Click to use Work Pattern” and the tick the days you would consider to be normal working days for this employee:

Recording the absence dates

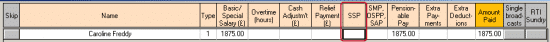

Go to “Payroll Calculations”

Double click into the SSP column on the temporary adjustments screen to open the SSP wizard:

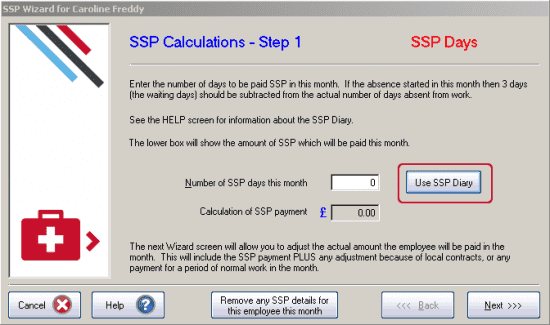

Click on “Use SSP Diary” to record the date range:

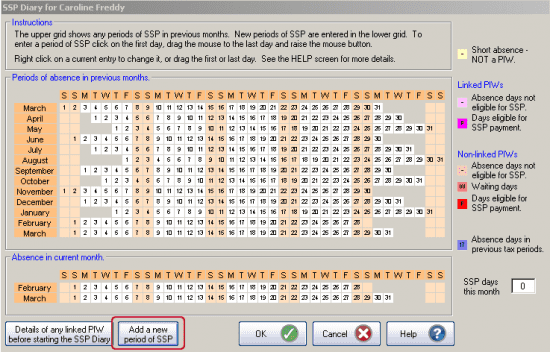

Click “Add a new period of SSP“:

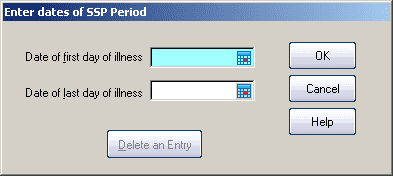

Enter the from and to dates of the absence:

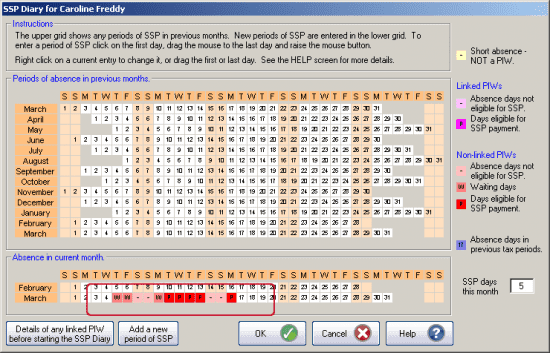

Click “OK” to return to the diary view. You should see the absence at the bottom of this window. You can check the entries again the key down the right hand side:

Click “OK” and then click “Next”

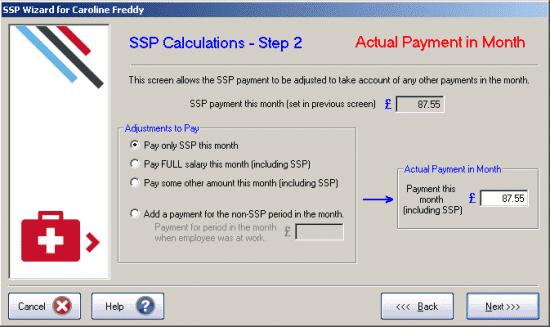

Actual Payment in Month

Here you can select how much TOTAL you want to pay the employee. This might cover a period of normal work done in the month or maybe contractual sick pay if applicable.

The value in the box on the right “Actual Payment in Month” shows the total amount you are going to pay the employee this period including the calculated SSP value.

Set this to the appropriate option and ensure the “Actual Payment in Month” value is correct before clicking “Next”.

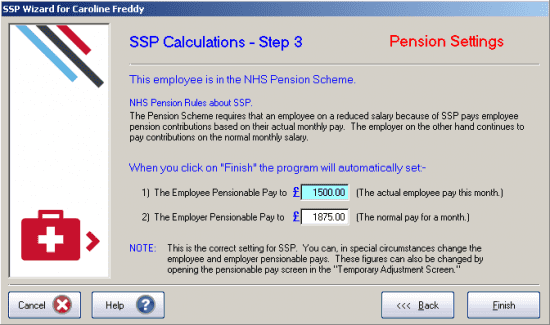

Pension Settings (Only if in NHS pension scheme)

The rules of the NHS Pension Scheme require that the employee pays contributions based on the actual amount paid in the month while the employer continues to pay contributions based on the normal full salary.

If the SSP wizard has spotted that this employee is being paid less than full salary you will see this extra screen:

This is arranging it so that the employee pensionable pay is the actual pay in the month while the employer pensionable pay is set to full salary.

It is possible to change the pensionable pay amounts on this screen but this should only be done in very special circumstances – IRIS GP Payroll has set the correct pensionable pay amounts for most circumstances. If you are in doubt contact the pension agency.

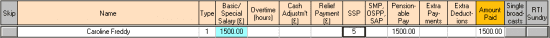

Click “Finish” to go back to the temporary variations screen:

You will see the SSP entry in place and the adjustment (if necessary) applied to “Basic/Special Salary” and “Pensionable Pay” values.

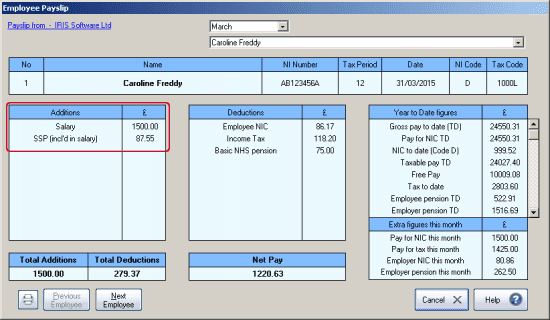

Calculate the rest of your payroll as normal and you’ll see the SSP element on the employee payslip:

Please Note: As of tax year 2014/15 you are no longer able to reclaim the cost of SSP paid against your PAYE remittance. As such you will not see SSP recovery on your P30/P32 reports. Additionally because there is no SSP recovery there is no requirement to send an EPS to report SSP paid (normal EPS rules still apply for other statutory payments).

Phased Return To Work

If you agree a phased return to work or altered hours after a period of sickness, pay SSP for the days that your employee is sick in the normal way. Any day for which SSP is paid will count towards the maximum entitlement of 28 weeks.

Your employee’s absence must form a Period of Incapacity of Work (PIW) ie. before SSP is paid. Remember, that is Statutory Sick Pay. You are not limited in what you decide to pay to the employee as salary/hourly rates.

For more details please refer to:

https://www.gov.uk/guidance/statutory-sick-pay-employee-fitness-to-work

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.