Month End Processing - P30 Summary

Article ID

11592

Article Name

Month End Processing - P30 Summary

Created Date

1st May 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

What is month end processing? How do I update my P30 summary?

Resolution

What is Month End Processing?

Month end processing is (usually) an automatic process which involves calculating the amount of tax and NI due to HMRC, producing the Month-End Summary report, updating values for EPS submissions and checking for any anomalies in the month’s pay figures. Each month, Payroll Business \ Bureau Payroll asks you if you want to perform Month end processing – we recommend that you do this every month.

NOTE: The month end summary is equivalent to a P32 report. The P32 is a record of all payments due to HMRC for all employees for a given pay period(s). The month end summary provides the same information.

Why do I need to run Month End Processing?

If you do not run Month End processing for one or more months, the running YTD values on your EPS will not be correct and you HMRC might recognise the situation as an underpayment. However, to help you avoid this situation Payroll Business \ Bureau Payroll allows you to perform Month End Processing manually at any time. So if you skip the automatic Month end processing for one or more months you can re-run it manually at any time. Even if you have already run Month end processing for a particular month, you can still re-run it.

Does Month End Processing Happen Automatically?

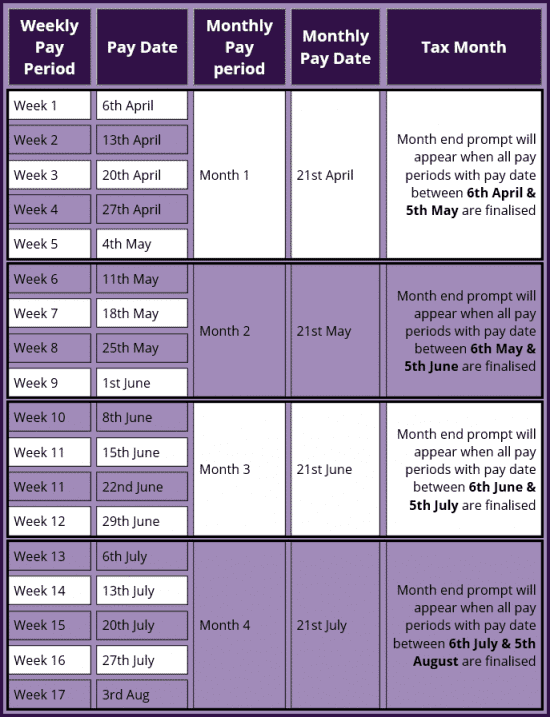

The option to perform Month end processing automatically appears after you finalise the last payroll in the current tax month. If you only have a monthly payroll, this will happen each time you finalise the payroll. Weekly payrolls (and 2-weekly and 4-weekly payrolls) are grouped into months according to which tax month the Pay Date falls into. Tax months run from the 6th of one month to the 5th of the following month. For example, the option to perform August’s Month end processing will appear when you finalise the last payroll with Pay Date on or before the 5th September.

For a combined payroll, the option for performing Month end processing appears when you are finalising the last payroll for the current tax month. For example, imagine you have a payroll with both weekly and monthly paid employees. You pay the weekly employees every Tuesday and the monthly employees on the 21st of the month. In month 1, the option to perform Month end processing appears when you finalise week 5; in month 2 it appears when you finalise week 9.

Performing Month End Processing Manually

If you choose not to perform Month end processing automatically on a particular month, or if you need to re-run it, you can perform Month end processing manually.

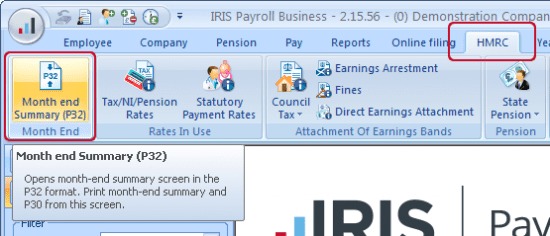

Click on the HMRC tab and click “Month End Summary (P32)“:

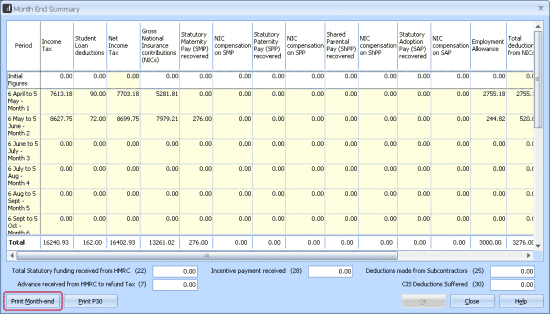

This opens the Month End Summary screen. Click “Print Month-end“:

This opens the Report Preview screen which displays the Month-end Summary report.

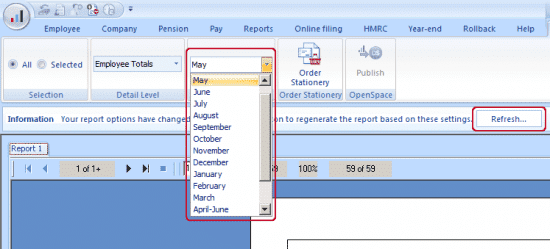

Check that the report is for the correct Month, if not use the drop-down arrow to select the correct month then click “Refresh“.

Click “Close” to close the Report Preview screen.

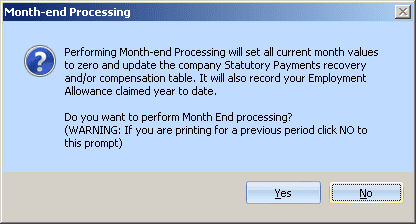

Payroll Business \ Bureau Payroll now asks if you want to perform the Month end processing.

Click “Yes“.

If you do not see the prompt to perform month end processing at this point, your payroll software is not recognising the completion of the tax month. Please check the date in your payroll calendar to ensure all periods within the tax month are finalised.

No Reporting Options On Screen

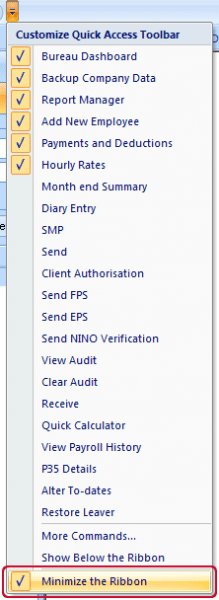

If you cannot see the report options ribbon when a report preview is on screen it will be because Windows is set to minimise the ribbon. To restore to the screen, click on the “Customise Quick Access Toolbar” arrow icon near the round application button (top left of screen):

Click on “Minimize the Ribbon” to untick the option:

This will ensure the report options are visible whenever a report is brought to the screen.

For further details on performing month end processing manually for previous tax months please read this KB article:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.