Starting / Stopping Student loan deductions

Article ID

11617

Article Name

Starting / Stopping Student loan deductions

Created Date

22nd September 2020

Product

Earnie

Problem

How do I start or stop a student loan deduction?

Resolution

Starting a Student Loan Deduction

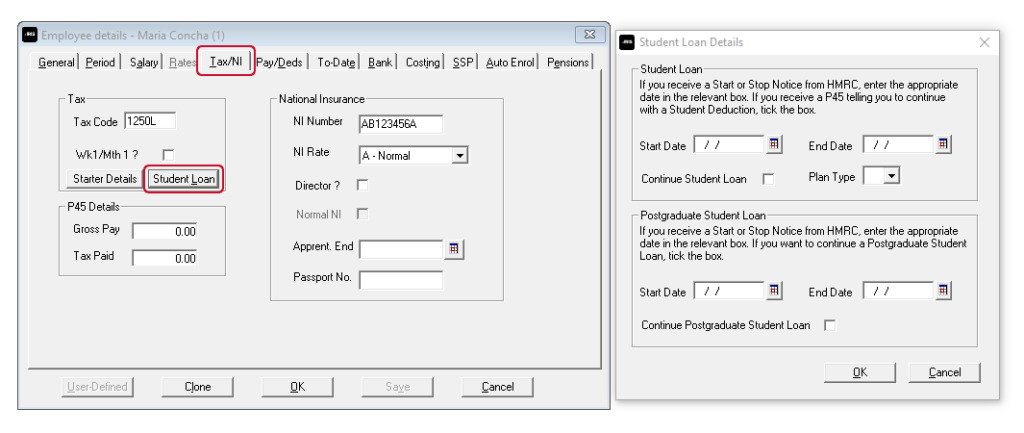

Student loans are managed in the employee details:

Open the employee details, go to “Tax / NI” and click on the button “Student Loan“

If you are starting the student loan because you have received an SL1 from HMRC type the date in “Start Date“

If you are starting the student loan because it is indicated on a p45, tick the option “Continue Student Loan” no start date is required.

Once saved with either a start date or ticked to continue student loan the system will automatically deduct student loans if the employee is paid enough.

You do not enter an “End Date” until you receive an SL2 notice from HMRC, see below “Stopping a Student Loan“

Student Loan Plan Type

As of the 2016/17 tax year, there is now an option of which student loan plan type the employee should be set to. The difference in the plan types is the threshold at which deduction will begin. The threshold for plan type 1 (20/21 tax year) is £19,390. The threshold for plan type 2 (20/21 tax year) is £26,575. BOTH plan types calculate deduction at 9% of the NIC liable pay. When you receive the SL1 from HMRC it will specify which plan type to use.

Please Note: There is no provision on the p45 form to indicate which plan type an employee should be on. When you add a new starter to the system, the employee needs to confirm the following;

• Did they live in Scotland or Northern Ireland when they started the course? OR

• Did they live in England or Wales and started the course before 1 September 2012?

If so, set them to plan type 1.

• Did they live in England or Wales and started the course on or after 1 September 2012.

If so, set them to plan type 2.

If your employee cannot confirm these details, ask them to contact the Student Loan Company (SLC). If they’re still unable to confirm their plan type, start making deductions using plan type 1 until you receive further instructions from HMRC.

Stopping a student loan

When you receive the SL2 message from the HMRC, return to the screen above and enter the “End Date” as supplied on the message.

Please note: Student loans will not be deducted if the employee’s earnings are below the Student Loan Threshold. For tax year 20/21 this is £19,390.00 (type 1) or £26,575 (type 2) . Student loans contributions are then 9% of all NIable pay over this amount. The deducted amount is always rounded down to the whole pound value.

Example calculation (Plan type 1)

The employee is paid £1800.00 NIable pay for the month.

Monthly Student Loan Threshold = 19390 ÷ 12 = £1615.83

Employee Pay subject to Student Loan = £1800.00 – £1615.83 = £184.17

9% of £184.17 = £16.58, rounded down to the whole pound, employee contribution is £16

Refunding a Student Loan

To simplify the process of refunding a student loan deduction we have added a new after tax and NI Student Loan Refund payment Category.

To set up a Student Loan Refund payment:

From the Company menu, select Alter Payments/Deductions

Click Add New

Click No when asked if you would like to use the Wizard

Enter a Name for the Payment

From the Category drop-down field, select Student Loan Refund

Tick other boxes as you may require, click OK to save

Once you have created the payment type, add this to the employee variations during payroll run and type in the value you wish to refund.

NOTE: Month-end processing and your FPS will reflect any Student Loan Refund. Refunds can be more than the To-Date value in Employee Details as it is possible to refund for previous tax years. However, the To-Date value itself will not go below zero.

Postgraduate Student Loan

From April 2019, Postgraduate Loans (PGL) are due to be repaid through PAYE. The repayment threshold has been set at £21,000 and loans will be repaid at a rate of 6%. Similar to current Student Loan start (SL1) and stop (SL2) notices, Postgraduate Loan start (PGL1) and stop (PGL2) notices will be downloaded with other HMRC Messages. Postgraduate Loan start and stop notices will be included in the same count as Student Loans.

From April 2019 an employee may be liable to repay a Student Loan and a Postgraduate Loan concurrently as these are separate loan products.

How the student loan repayments are calculated

Postgraduate loans will not be deducted if the employee’s earnings are below the Postgraduate Loan Threshold. For tax year 20/21 this is £21,000. Postgraduate loans contributions are then 6% of all NIable pay over this amount. The deducted amount is always rounded down to the whole pound value.

Example calculation:

The employee is paid £1800.00 NIable pay for the month.

Monthly Student Loan Threshold = 21,000 ÷ 12 = £1750.00

Employee Pay subject to Student Loan = £1800.00 – £1750.00 = £50.00

6% of £50 = £3, rounded down to the whole pound, employee contribution is £3

Postgraduate Student Loan Refund

We have added a new Payment/Deduction Category of Postgraduate Student Loan Refund to the payroll software.

To use this new Category:

- Go to Company | Alter Payments/Deductions

- Click Add to create a new entry

- From the Category drop down, select Postgraduate Student Loan Refund

- The rest of the form will be completed for you

Student loan deductions are included in the PAYE costs for the employer on the month end summary (p32) report. These values get added to the other PAYE liabilities for the company and are paid to HMRC directly along with the tax and NI due. You do not need to send payments to any other body.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.